“Everybody’s lookin’ for somethin’,” because the music says. And you’re in search of a technique to settle for bills that isn’t bolted to the ground. But should you’re right here, that would possibly imply you haven’t slightly discovered it but.

We let you with that seek. In reality, it’s possible you’ll in finding that choosing the right processor for taking cellular bills is nearly as simple as pinning down what you imply via “mobile.”

Top cellular bank card processing comparability

As we talk about in deeper element additional down within the article, there are a selection of key causes you may well be in search of cellular bank card processing particularly.

Whether it’s simply the added comfort of with the ability to elevate your POS resolution round your place of work or your line of labor necessitates one thing that will get the process completed some distance from the comforts of civilization, something is obvious: a normal checkstand isn’t what you’re in search of.

Now, with all that during thoughts, we spotlight essentially the most important issues — i.e., those that may in all probability sign if an answer received’t be the best have compatibility for you. Peruse mentioned desk, then bounce right down to the record to be informed extra in regards to the ones that meet your requirements at a look.

| Our ranking (out of five) | Starting subscription charge | Lowest transaction rate | Lowest-price POS {hardware} | Offline mode? | |

|---|---|---|---|---|---|

| Square | 4.83 | Starting at $0 per thirty days | 2.6% + $0.10 | Square Reader (loose) | Yes |

| SumUp | 4.56 | Starting at $0 per thirty days | 2.6% + $0.10 | SumUp Plus ($54) | Depends on POS {hardware} |

| Payment Depot | 4.43 | By quote | “Interchange Plus”, as little as 0.2% | None (Third-party solely) | Depends on POS {hardware} |

| Helcim | 4.16 | No subscription rate | Base interchange, plus 0.15% + $0.06 | Helcim Card Reader ($99) | No; cellular or wifi connection required |

| Payanywhere | 4.16 | Starting at $0 per thirty days | 2.69% | Payanywhere 3-in-1 Reader (loose) | Yes |

| GoDaddy | 4.06 | No subscription rate | 2.5% + 0¢ | Tap to Pay by way of cellular | No; cellular or wifi connection required |

| Clover | 4.06 | Starting at $0 per thirty days | 2.3% + 10¢ | Clover Go ($199) | Yes |

| PayBuddy | 4.03 | No subscription rate | 2.29% + $0.09 | PayBuddy Card reader ($29) | Yes |

Square: Best general

Our ranking: 4.83

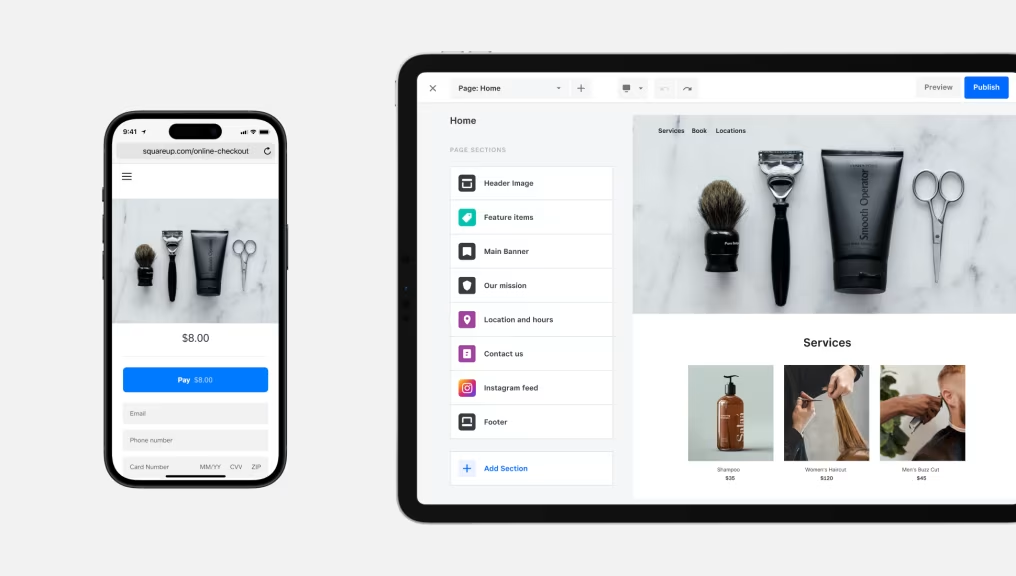

Square tops numerous our POS and fee best-of lists. And, it’s now not with out just right explanation why. In some ways, Square birthed all of the class of monetary answers it now dominates. Their flagship product, a square-shaped telephone peripheral enabling card-present bills, was once the primary of its type.

To this present day, the freebie card reader they ship to newly signed accounts lowers obstacles to access and empowers small companies to show their passions into professions.

Why I selected Square

As you’ll have spotted above, Square assessments the entire main bins for this record. Reasonable transaction charges, no subscription charges, loose card reader on signup, and offline capability — you must do so much worse than Square as each a POS and a service provider services and products supplier. On the opposite, nearly all of new and rising companies will most probably in finding Square provides all they want, after which some.

Pricing

- Free: pay solely the transaction charges, beginning at 2.6% + $0.10 in keeping with transaction.

- Plus: beginning at $29 per thirty days, plus processing charges.

- Premium: customized pricing (plus processing charges).

Features

- Free Square Reader with each and every account (and signing up is loose, too).

- Reliable carrier from a depended on emblem; take just about each and every imaginable fee way, from just about any place (even offline).

- Plenty of POS {hardware} to make a choice from.

Pros and cons

| Pros | Cons |

|---|---|

| Affordable transaction charges for in-person bills. | Fees scale up temporarily for card-not-present transactions. |

| Offline mode for when the Wifi Spirits fail you. | Square POS {hardware} and fee processing move hand-in-hand; should you’re the use of one, you’re the use of each. |

| Free card reader, and loose subscription tier, with room to improve each if you wish to have it. | Free card reader solely takes swipes. |

SumUp: Best finances possibility

Our ranking: 4.56

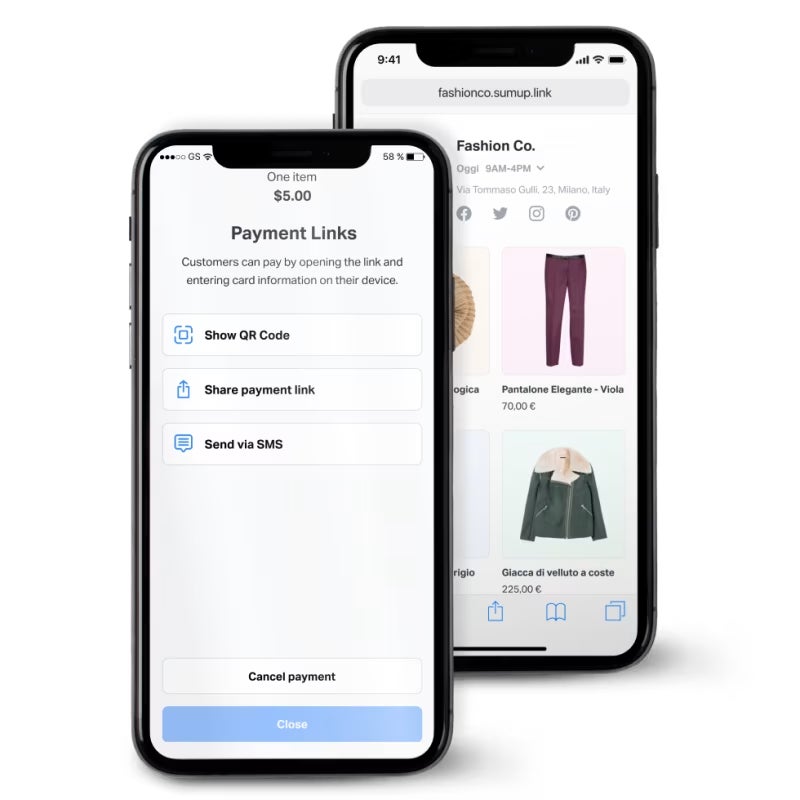

SumUp is analogous in some ways to Square in each pricing and capability. With no beginning charges and various low cost choices, it’s a budget-friendly technique to many issues smaller companies face. What units them aside, even though, is what’s incorporated within the upgrades.

Though you’ll get started the use of SumUp free of charge, and will pick out up a cellular card reader for as low as $54, SumUp provides upgrades in each their {hardware} and their services and products, either one of which come at decrease prices than what competition price for similar options.

Everything from cellular POS with receipt printing to buyer loyalty options and advertising automation, SumUp provides room to develop with minimum monetary pressure.

Why I selected SumUp

It’s now not unusual for extra complicated {hardware} and lines to temporarily exceed the finances of latest and rising companies. Some POS {hardware} is going for hundreds only for a unmarried station. And trade services and products like SMS/e-mail advertising, buyer loyalty techniques, and identical B2B answers are continuously a whole trade type unto themselves (with a ticket to compare).

SumUp is slightly other. With reasonably priced transaction charges and flat subscription pricing, you’re by no means guessing how a lot you’ll need to pay. And with their upgraded choices more cost effective than many in their friends within the house, it’s more uncomplicated to go for extra complicated equipment if you wish to have them.

Pricing

Transaction charges:

- In consumer: 2.6% + $0.10.

- Online/guide access: 3.5% + $0.15.

- Invoicing: 2.9% + $0.15.

Subscription charges:

- POS Lite: Free.

- SumUp POS with Connect Lite: $99 per thirty days.

- SumUp POS with Connect Plus: $199 per thirty days.

- SumUp POS with Connect Pro: $289 per thirty days.

Features

- Dedicated set up and coaching.

- Free and low cost choices for many who want them.

- Upgraded subscriptions come with advertising automation and buyer loyalty options.

- Advanced {hardware} able to stock control and extra.

Pros and cons

| Pros | Cons |

|---|---|

| Affordable resolution. | Offline mode solely to be had on desk bound {hardware}. |

| Also nice as an affordable “upgraded” resolution, each in {hardware} and device. | Not as just right a have compatibility for higher groups or extra complicated companies. |

| More choices to make a choice from than even different competition on this record. | There are more cost effective answers should you plan to do numerous on-line promoting. |

Payment Depot: Best for wholesale transaction charges

Our ranking: 4.43

Our solely processor-only access at the record, Payment Depot is appropriate with various Third-party POS {hardware} choices, however doesn’t have any branded tools of their very own.

Instead, Payment Depot’s complete price proposition is mainly “Costco, but for processing card transactions.”

By paying a flat subscription rate (decided via your gross sales quantity), you get get admission to to “Interchange Plus” pricing — a type the place as an alternative of paying a uniform transaction rate, the processor provides a flat, unchanging margin on most sensible of each and every interchange rate. In different phrases, your fee in keeping with swipe shall be variable, however you’ll be paying the bottom imaginable rate each and every time.

Why I selected Payment Depot

Interchange charges are…roughly in every single place. The charges that banks and card issuers price for a given transaction range via location, card sort, what colour of socks you’re dressed in that day, and a number of different issues (adequate, a kind of may well be hyperbole, however now not via a lot).

Most of the time, suppliers maintain this via leveling issues out, and charging you a flat rate. That’s more uncomplicated to know and more uncomplicated to calculate for you, but it surely implies that should you get numerous trade with decrease interchange charges, you’re paying greater than you must.

Payment Depot does the other. Rather than simplify to the detriment of financial savings, they prioritize financial savings, even supposing it way the pricing will get slightly extra complicated. Of the choices available on the market, the ones providing interchange plus are the least dear in keeping with transaction. And since Payment Depot doesn’t make its personal POS {hardware}, you’re loose to carry your personal software slightly than purchase a dear branded product.

Pricing

Subscription prices with Payment Depot are via quote solely, and their charges are variable, so that you’ll need to touch them for specifics. However, interchange plus is broadly permitted as essentially the most reasonably priced transaction rate construction.

Features

- Low-cost interchange plus pricing.

- Compatible with a lot of POS {hardware}/carrier manufacturers, like Clover (see additional down within the record).

- Support is to be had 24/7.

Pros and cons

| Pros | Cons |

|---|---|

| Save near to up to imaginable with each and every transaction. | Doesn’s make stronger high-risk companies. |

| Pick a POS supplier in accordance with your desire and wishes, slightly than being caught with the processor’s proprietary stuff. | Not as recommended for low-volume use (like we mentioned—Costco for processors). |

| No setup charges. | Between quote-based pricing and variable charges, charge construction is much less clear than we would really like. |

Helcim: Best for low charges and surcharging

Our ranking: 4.16

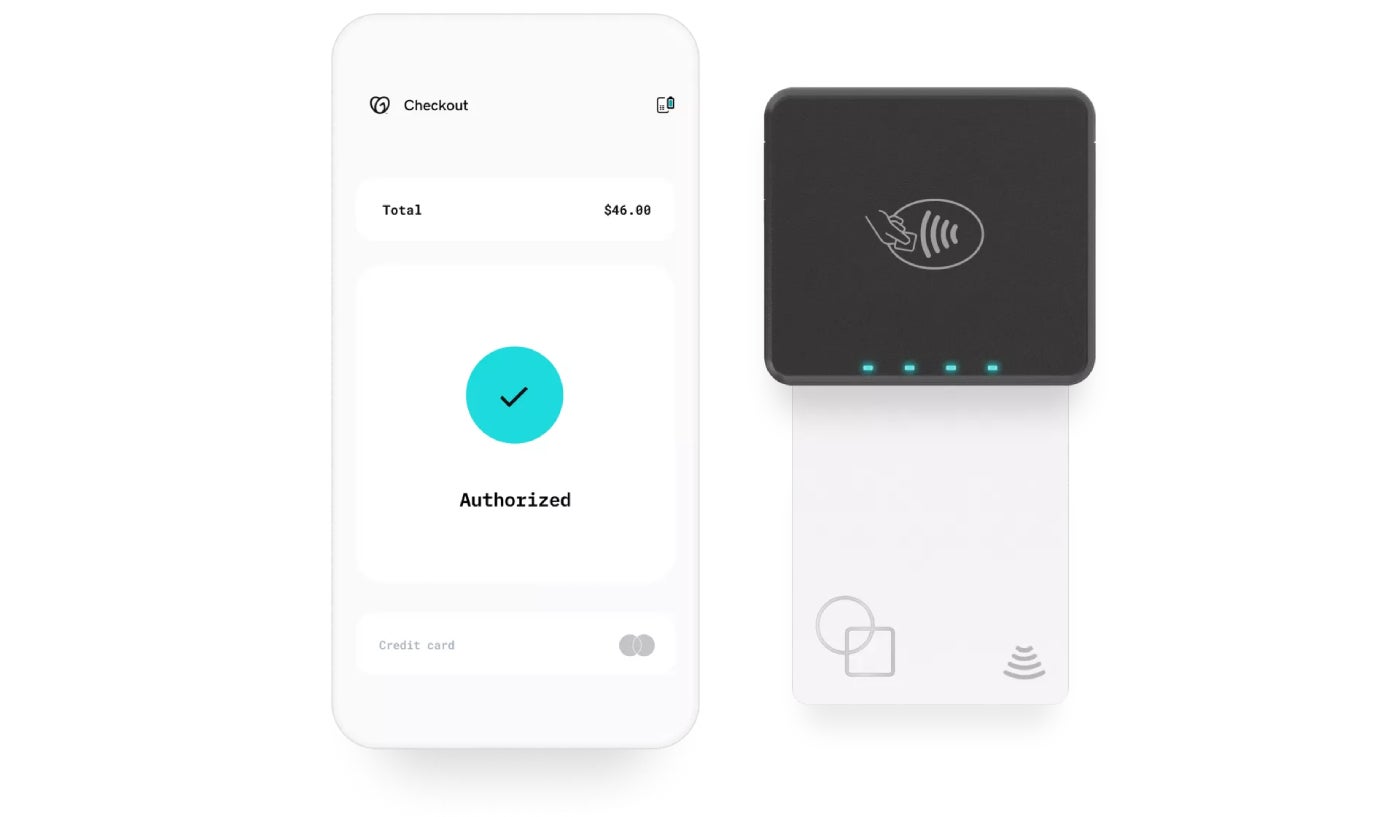

Helcim is some other interchange plus processor, like Payment Depot. That way they boast most of the similar advantages and benefits. However, not like Payment Depot, Helcim does now not include a per month rate. And, they do have their very own POS {hardware}, even though their variety may be very restricted (simply two cellular choices, in truth). They be offering some further perks, like ordinary fee subscription make stronger, so to set a buyer’s bills on a cycle.

What units Helcim aside, alternatively, is how you’ll move by way of processing charges to consumers by way of Helcim’s surcharging function, which can also be toggled on or off for each and every transaction.

Why I selected Helcim

Helcim has various benefits similar to its friends in this record, however its pass-through possibility for charges is a will have to should you’re working a nonprofit or charity, or simply merely taking a look to reduce transaction charges. And with Helcim the use of Interchange Plus pricing, the ones charges are already relatively low.

Pricing

Helcim doesn’t price per month charges or lock you into contracts. They price interchange plus charges, which means the fee is extremely variable, however Helcim’s lower isn’t:

- For volumes as much as $50,000: Interchange+ 0.40% + $0.08.

- For volumes from $50k to $100k: Interchange+ 0.35% + $0.07.

- For volumes from $100k to $500k: Interchange+ 0.25% + $0.07.

- For volumes from $500k to $1 million: Interchange+ 0.20% + $0.06.

- For volumes above $1 million: Interchange+ 0.15% + $0.06.

As for Helcim’s POS {hardware}, you may have two branded choices:

- Helcim Card Reader: $99.

- Helcim Smart Terminal: $329, or $30/month for twelve months.

Features

- Payment gateway, invoicing, digital terminal capability, and extra.

- Subscription supervisor so to arrange ordinary bills from consumers/buyers/donors/and many others.

- Inventory control for many who want it.

- Interchange Plus pricing, with pass-through rate choices.

Pros and cons

| Pros | Cons |

|---|---|

| Lower transaction prices than virtually any competing choices. | Slower deposit speeds than others on this record. |

| Pass-through charges receive advantages donations and charity bills. | Fewer POS {hardware} choices. |

| Discounts for running at upper quantity. | |

| No per month charges. |

Payanywhere: Best for fast payouts

Our ranking: 4.16

Let’s face it: we’d all wish to have our cash sooner, wouldn’t we? Unfortunately, maximum fee processing and different monetary services and products have integrated delays that stall and gradual a procedure that differently turns out prompt. And whilst expedited bills are infrequently to be had as choices, they generally charge additional.

Payanywhere gifts an alternate. With loose next-day payouts and the prospective to qualify free of charge same-day payouts, Payanywhere makes fast payouts more uncomplicated and more cost effective than virtually somebody else.

Why I selected Payanywhere

Do you wish to have sooner payouts? ‘Cause that is the way you get sooner payouts. Jokes apart, Payanywhere brings the entire standard suspects to the lineup — dependable fee processing with quite a lot of cellular fee choices. Affordable, pay-as-you-go pricing. Invoicing, reporting, tap-to-pay on cellular, the works. Beyond that, you receives a commission sooner at much less expense. And they also have choices for stock and worker control.

Pricing

Pay as you move:

- Swipe/dip/faucet: 2.69%.

- Keyed: 3.49% + $0.19.

Custom pricing: name for quote.

Monthly device rate:

- Mobile 3-in-1 card reader: None.

- All others: From $14.95/month to $44.95/month.

Features

- Inexpensive and even loose next-day and same-day investment.

- Employee control.

- Inventory control.

- In-person, digital, on-line, and virtual storefront fee processing.

Pros and cons

| Pros | Cons |

|---|---|

| Do the entirety maximum different fee processors will let you do, however receives a commission sooner whilst doing it. | Added charges for inactiveness and early termination. |

| Plenty of {hardware} to make a choice from to fulfill your wishes. | Smaller integration library than others. |

| Offline mode for many who paintings at the move. | Doesn’t settle for some trade varieties. |

GoDaddy: Best in-person/ecommerce combo

Our ranking: 4.06

So some distance, we’ve been closely fascinated by in-person fee interactions. But let’s be fair — ecommerce companies aren’t precisely a small demographic. Even when simply taking into account solo outfits and small groups. And now not each and every processor is as conducive to a bilateral gross sales channel.

Square, for instance, is lower than stellar with ecommerce. It has ecommerce equipment, but it surely provides the lion’s percentage of its options to in-person dealers. Great, if that’s all you do. Not such a lot if 50% or extra of your small business comes from virtual visitors.

GoDaddy is helping fight this downside. The emblem is way more well-known for its area services and products and information superhighway website hosting as a result of that’s the place they began. Where Square moved from card-present transactions to on-line channels, GoDaddy did the opposite, and their ecommerce pricing displays that.

Why I selected GoDaddy

It’s no a laugh seeing a killer charge on all of your in-person card transactions, solely to choke at the dimension of the costs gouging your on-line income. GoDaddy’s carrier isn’t like that. Their ecommerce fee is nearer to their in-person fees than some other possibility in this record.

Their broader POS and fee options can definitely move toe-to-toe with their friends on this record. But they take the cake for somebody who needs to promote face-to-face and thru web-based channels.

Pricing

GoDaddy lists clear pricing for his or her transaction rate construction, making it simple to spot in case your maximum commonplace processing varieties shall be properly served via the platform:

- In-person: 2.5% + $0.00.

- Ecommerce: 2.7% + $0.30.

- Invoicing: 2.9% + $0.30.

- Online Pay Links: 2.9% + $0.30.

- Keyed-in: 3.5% + $0.00.

However, they’re a little bit much less clear about explaining their subscription charges. They do record some pricing, akin to their controlled WooCommerce retail outlets (beginning at $24.99/month). And they explicitly point out how you’ll get began the use of their POS services and products free of charge. As of this writing, alternatively, the hyperlinks on their website online for specifics on top rate plans, like Point of Sale Plus, simply direction you again to pages that don’t record a value.

Beyond that, it’s now not completely transparent which subscription you’ll wish to duvet the variety of purposes you wish to have, be {that a} complete Woocommerce plan, or one thing else.

**Disclaimer** In GoDaddy’s protection, POS, cellular bills, and different in-person choices are fresh additions to their portfolio. So a few of this confusion is most probably because of fine-tuning and common changes being completed on their finish as they roll it out in complete. There’s even a banner flagging this very element on their Point of Sale Plan documentation web page.

Features

- Inexpensive in-person bills. Similarly priced ecommerce transactions.

- Rapid payouts, as speedy as next-day.

- They’re well-versed in serving to companies run their operations on-line, and generate profits by way of virtual channels — in truth, their complete platform is designed round it.

- A boatload of different options and capability in addition, a lot of which revolve round integrations, automations, and information superhighway website hosting.

Pros and cons

| Pros | Cons |

|---|---|

| Get fee processing, POS answers, and web page website hosting, multi function. | Reportedly, one of the most reasonably priced pricing that’s introduced to new traders provides technique to much less favorable rate constructions after introductory classes finish. |

| You’ll be hard-pressed to discover a seller that provides each in-person and on-line processing that’s so shut in fee. | They be offering a loose trial, but it surely’s restricted in scope. |

| It’s a well known and well-used platform, so there are a large number of avenues to seek out the lend a hand and help you wish to have. | The POS/in-person options are more moderen, and thus each the capability and the ideas remains to be “under construction,” as they are saying. |

Clover: Best for number of processor

Our ranking: 4.06

Clover is a broadly used, and broadly supported, POS emblem. Offering each tough device and all kinds of {hardware}, they cater to part a dozen distinctive business verticals, from eating, to retail, to skilled services and products, and past.

With Clover, you may have the approach to carry your personal processor. Clover is owned via Fiserv, and, whilst you’ll acquire {hardware} immediately from the Clover web page with Fiserv processing and charges, you’ll additionally acquire Clover {hardware} from any processor that operates at the Fiserv community.

Luckily, Clover is among the most well liked choices available on the market, so maximum processors fit (even in instances the place the ones distributors have their very own POS {hardware} choices).

Why I selected Clover

It’s unusually tough to discover a matching POS possibility should you’ve already were given your service provider account in position.

That makes Clover slightly of an oddity; they’re now not new to the distance, however they’ve endured to carry the road as some of the perfect point-of-sale equipment available on the market. There’s lots to like about Clover prior to you even get started digging into a few of their extra complicated options and services and products.

Pricing

Pricing for Clover is obviously mentioned on their web page, but it surely’s additionally extremely variable in accordance with a couple of components:

- The business you’re employed in.

- The form of POS {hardware} you’re the use of.

- The subscription tier.

Each business provides 3 tiers: Starter, Standard, and Advanced. The baseline per month rate is $14.95 per thirty days, even though you’ll additionally upload per month bills for {hardware} by way of a three-year fee settlement (so that you don’t need to money out for a dear POS station all of sudden). Some starter plans don’t have any per month rate, even though.

And in the end, Clover advertises transaction charges as little as 2.3% + $0.10.

However, word that the pricing will range if you buy your cellular Clover reader from a unique processor.

Features

- Low transaction pricing, to pair along with your present processor financial savings.

- Plentiful POS {hardware} choices, from cellular readers and units, to complete sign in stations.

- Robust device able to supporting quite a lot of very particular use instances.

Pros and cons

| Pros | Cons |

|---|---|

| Bring your personal service provider account. | Buying {hardware} by way of fee plan locks you right into a three-year contract. |

| Some of the most productive POS {hardware} and device within the trade. | Fees can upload up should you do numerous on-line promoting. |

| Advanced options are tailored for eating places and retail companies, like on-line meal orders, on-line retailer integration, and extra. | Some commonplace, and essential, integrations (akin to with accounting programs) require further setup and Third-party apps. |

PayBuddy: Best devoted cellular POS software

Our ranking: 4.03

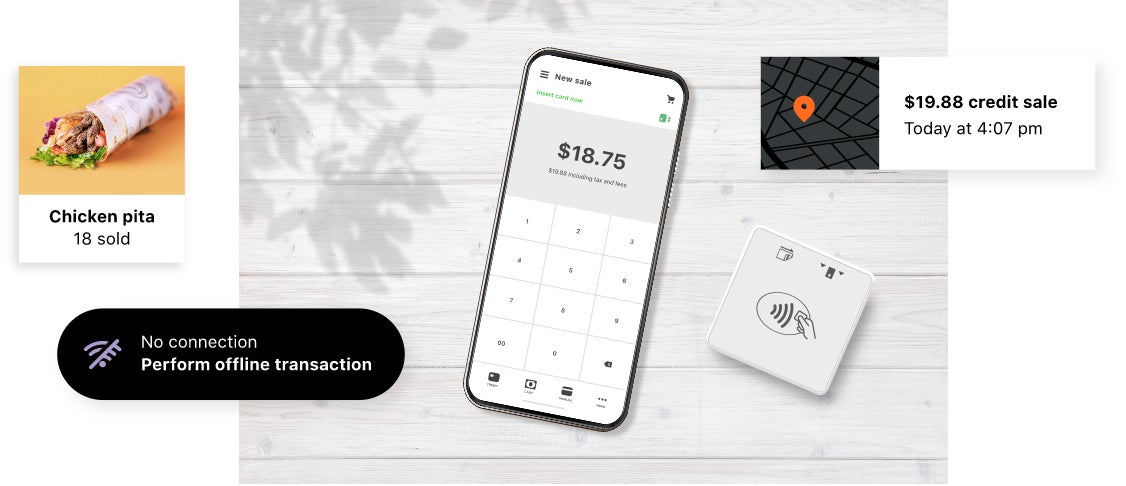

Another well known participant within the bills house, PayBuddy is generally recognized for its on-line processing and fee portals. But that’s to not say it doesn’t have a horse within the race, with the intention to discuss. In reality, PayBuddy Zettle is our pick out for many who desire a devoted cellular POS (versus simply the use of their telephone by way of Tap to Pay or with a card reader).

PayBuddy provides some of the least dear choices available on the market for the use of a devoted hand held, with cellular knowledge connection. Transaction charges are not up to reasonable with the hand held, and there’s no per month subscription rate to make use of it. And should you’re prepared to make use of your PayBuddy account within the procedure, you’ll get your cash in mins. If a easy smartphone received’t lower it for your small business, this most certainly will.

Why I selected PayBuddy

While smartphones can take care of slightly a little bit within the realm of accepting and processing bills, there are some things they are able to’t do. It can’t print a receipt by itself. It struggles to take care of barcodes with out further device or {hardware}. And you’re most certainly the use of it for issues as opposed to simply bills, so logistics and battery lifestyles transform considerations.

Oh, and nobody likes sharing their telephone, so the use of your individual software can get iffy if there are more than one other folks or places concerned.

But getting a devoted software from maximum distributors has a tendency to come back with some lovely hefty added prices. With PayBuddy, you’ll move complete smartphone if that’s what works. You can go for desk bound POS setups if wanted. Their Zettle cellular POS, even though, is a degree of budget-friendly comfort that’s demanding to compete with.

Pricing

PayBuddy doesn’t require any subscription charges. As for his or her transaction charges, PayBuddy’s pricing construction breaks down in a similar way to a few in their friends, even though they provide higher charges than maximum in some key spaces:

- Card-present: 2.29% + $0.09.

- Manual access: 3.49% + $0.09.

- QR code transactions: 2.29% + $0.09.

- Invoicing by way of PayBuddy: 3.49% + $0.49.

- Invoicing by way of choices: 2.99% + $0.49.

Finally, it’s value bringing up the prices of PayBuddy’s cellular units:

- Mobile card reader: $29 to your first card reader ($79 in keeping with reader after that).

- Zettle cellular POS terminal: $199 for the standalone terminal. Built in barcode scanner improve and receipt printer improve are each additional.

Features

- Low transaction charges for in-person bills.

- Affordable cellular units for doing trade at the move.

- Mobile knowledge utilization is roofed within the Zettle acquire fee.

Pros and cons

| Pros | Cons |

|---|---|

| Some of essentially the most reasonably priced choices for cellular bills. | If you wish to have so as to add on-line bills, issues get a little bit pricier. |

| No contracts, no subscription charges, no per month bills (and {hardware} affordable sufficient to make it value it). | Some of PayBuddy’s choices make stronger offline bills, however as of this writing, their cellular POS answers don’t. |

| Get your cash in mins if the use of your PayBuddy account. |

How do I make a choice the most productive cellular bank card processor for my trade?

Ok, complete disclosure, we duvet slightly a little bit of overlapping subject matter in a few of our different articles. The traces between point-of-sale techniques and fee processors can get roughly blurry, and “mobile” could be a slightly large and nebulous class.

Had we been ready to talk with you in consumer in this topic, we’d unquestionably have requested you a follow-up query:

Exactly how some distance do you wish to have to get lost the crushed trail when taking a fee?

“Just trying to get my steps in”

Maybe this dates us a little bit, however the ones cordless landlines have been an actual game-changer again within the day. Not having to face within the kitchen awkwardly, whilst everybody walked round you, simply to take a telephone name? It was once nice. Of direction, you couldn’t move very some distance prior to the reception was once extra static-y than your grandparents’ black-and-white TV. But a minimum of you must transfer round a little bit.

Some companies are in search of one thing on this ballpark, mobility-wise. You most certainly have a devoted place of work — a cafe, a retail retailer, a kiosk on the native mall. Whatever the case, you’ll have dependable get admission to to each web and gear, even though you is probably not plugged in 100% of the time.

You would possibly want further POS {hardware}, like a receipt printer, a money drawer, or identical. Or you may well be tethered to positive proximity barriers, for no matter explanation why. You would possibly also be able the place merely the use of smartphones isn’t a great resolution (don’t need the ones sprouting toes and working off, ?).

Whatever the case, you continue to want (or a minimum of get pleasure from) a cordless revel in, or even a brief quantity of wi-fi vary will do you some just right.

“I’m not one to ‘settle down’”

If the former class didn’t sound such as you, then how about this one? Maybe you don’t have a devoted place of work or retail house. Perhaps you’re employed someplace that doesn’t supply dependable Wifi, or the place you must plan for lengthy stretches with out get admission to to an influence outlet.

Or, it may well be that you simply don’t want or need the rest as opposed to your personal smartphone to take care of trade transactions (devoted {hardware} can also be expensive, in the end).

With contactless card bills changing into increasingly commonplace, or even cellular wallets proving relatively normal at this level, some companies can serve as virtually frictionlessly with out even desiring a magstripe or chip reader peripheral. And, must you in truth want one, the ones are the very best and least dear POS equipment to come back via.

Just make sure to’re doing trade someplace with mobile carrier. Otherwise, you’ll finally end up within the subsequent team.

“I sell off the beaten path”

Internet get admission to is painfully simple to take with no consideration at this level in society, and the ones unsightly “no service” surprises occur to the most productive folks. In maximum scenarios, we simply put our telephone again in our pocket, grumble underneath our breath, and maintain it. But if it’s a trade transaction, there’s a little bit extra at the line than simply an interruption for your Spotify circulate.

POS and fee processing distributors know this, and a few of them have constructed choices to handle problems like those. Colossal battery lifestyles for POS handhelds. Offline capability for processing device. Whatever your greatest worry, odds are there’s a emblem with a worth prop aimed squarely at it. You need to do trade anywhere you wish to have to, and so they need to lend a hand (for a small rate, after all).

Honorary point out: the “why not both?” crowd

Lest we overlook, this isn’t simply a point-of-sale dialogue. It’s additionally a fee processing dialogue. And bills are available in…simply such a lot of bureaucracy in this day and age. So the general level of attention right here (of the ones which are distinctive to this actual area of interest of the wider subject, after all) is whether or not you wish to have POS equipment to compare your processor, a processor to move with the POS software you’re the use of, or slightly of each.

If you’re manually typing in card data by way of a desktop app and simply desire a seller to facilitate the true transaction, numerous the opposite main points don’t truly subject a lot. Similarly but inversely, should you’re all set with a service provider account however truly desire a technique to take the ones magstripe bills, that may impact your record of applicants (as many distributors be expecting you to make use of their branded or partnered processing resolution).

While you’ll at all times need to vet a tech seller for the usual values, like buyer make stronger, fee, safety, and many others., the “right pick” for you are going to in the end be determined via those more effective main points, in all probability. So make sure you allow them to form your purchasing adventure.

Methodology

In our seek for mobile-friendly card readers, fee processors, and the like, we constructed a listing of applicants and graded mentioned applicants in accordance with important core components, together with pricing, device options, {hardware} choices, consumer revel in, and reliability. We consulted branded advertising, overview aggregator websites like G2, hands-on demos, and loose trials, in addition to comments and opinions from present and previous customers.

We paid specific consideration to spaces of capability that have been non-standard, in the event that they have been discussed within the emblem’s advertising as an to be had function and whether or not or now not opinions indicated it labored as described.

Here are the precise standards utilized in our analysis:

- Pricing: 20%

- We tested processing charges, contract phrases, cancellation charges, chargeback charges, and the prices of cellular card readers themselves.

- Payment varieties: 25%

- We checked whether or not each and every cellular processor can settle for card-present transactions, invoicing, all kinds of contactless bills, break up gentle choices, SMS text-to-pay, Tap to Pay, and extra.

- Features: 25%

- We checked for offline processing, loose POS equipment, product libraries, the power to ship virtual receipts, and deposit or payout speeds.

- UX: 20%

- We evaluated its general ease of use, app or cellular interface, and its talent to combine with different common trade device like QuickBooks for accounting.

- User opinions: 10%

- Finally, we assessed each and every processor’s Google Play app ranking, iOS app ranking, and general recognition.

It’s at all times tough to get a complete image of what a tech resolution has to provide, particularly whilst you’re now not able to box take a look at it immediately or discover the way it plays in numerous area of interest use instances. We’ve completed our perfect to near that hole right here and “fumble in the dark” for your behalf, that can assist you steer clear of doing the similar at a lot better alternative charge.

No Comment! Be the first one.