Up to date in October 2024

The funds and fintech business is present process a rare transformation, with world fintech investments anticipated to surpass $300 billion by the top of 2024. Digital wallets, embedded finance, and real-time funds are just some of the improvements redefining how cash strikes. Consequently, staying on prime of the newest developments can really feel overwhelming.

One of many quickest and only methods to keep knowledgeable is by following business leaders on social media. These specialists share real-time insights, market shifts, and rising tendencies from the funds and fintech house, guaranteeing you’re all the time updated. The truth is, with over 60% of business professionals turning to social platforms for breaking information, partaking with thought leaders on-line has grow to be a key technique for staying aggressive.

Past updates, social media presents you the prospect to attach with these specialists, alternate sensible recommendation, and construct helpful relationships. Whether or not you’re simply beginning out within the funds and fintech ecosystem or seeking to keep forward of rising tendencies like synthetic intelligence, decentralized finance, and cross-border funds, following these influencers is important.

So, get able to supercharge your social feed! Listed here are 51 of the highest funds and fintech specialists to comply with in 2025 and past (listed alphabetically):

1. Alberto Garuccio

Alberto Garuccio is the Head of Ecosystem at Reale Mutua Assicurazioni, in addition to the Insurtech Thought Chief at Techstars, the place he curates a devoted digest and evokes and helps Techstars entrepreneurs in defining enterprise fashions new tendencies and gamers in Insurance coverage sectors.

Comply with him on Twitter | LinkedIn

2. Alex Jiménez

Alex Jiménez is the Lead Principal Advisor at Backbase and Awards Decide for the Finnovate Awards. Previous to his present function, he was the Chief Technique Officer at Finalytics.ai and Extractable.

His different experiences embody growing and managing Digital Banking and Funds Technique at Rockland Belief, a neighborhood financial institution in Japanese Massachusetts. He additionally served because the Chair of the Shopper Bankers Affiliation’s Digital Channel Committee. Not too long ago, Alex served as a member of the American Bankers Affiliation’s Fintech Committee, and was a Vice President and Senior Strategist at Zions Bancorporation, the place he led the general expertise funding planning course of for the workplace of the CIO.

Comply with him on Twitter | LinkedIn | Web site

3. Alex Johnson

Alex Johnson is the founding father of Fintech Takes, a media model devoted to exploring the dynamic crossroads of economic providers, expertise, and public coverage. Via his twice-weekly publication and in style podcast, Alex delves into the improvements and corporations reshaping how cash strikes, mixing insightful evaluation with partaking analogies and popular culture references.

With over twenty years of expertise in advertising, technique, and market analysis, Alex has held key roles at organizations equivalent to Cornerstone Advisors, FICO, Mercator Advisory Group, and Zoot Enterprises. As a acknowledged authority within the fintech house, his experience has been featured in main publications and media retailers, together with American Banker, The Wall Avenue Journal, and NBC Nightly Information.

Comply with him on Twitter | LinkedIn | Web site

4. Anne Boden

Anne Boden is the founder and former CEO of Starling Financial institution and the primary girl founding father of a British financial institution. In 2018, she acquired an MBE for providers to monetary expertise. Anne sits on the FinTech Supply Panel for UK tech community Tech Nation and is a keynote speaker at business occasions equivalent to Money20/20 and Wealth 2.0.

Anne is the creator of Banking On It: How I Disrupted an Business and Feminine Founders Playbook: Insights From the Superwomen Who Have Made It.

Comply with her on Twitter | LinkedIn

5. Arin S

Arin is Vice President at a stealth mode start-up, and has over 21 years of expertise in driving industrial targets, new market enlargement, and main and managing diversified monetary providers. He has in-depth data of funds, cost strategies, and the web gaming enterprise.

Comply with him on Twitter | LinkedIn

6. Invoice Sullivan

Invoice Sullivan is a globally acknowledged fintech influencer, with common talking appearances at main business conferences and quite a few interviews with tier 1 and commerce media. He’s the Government Vice President of Progress at Holding Present Issues and previous to that was additionally the Vice President and International Head of Monetary Companies Market Intelligence at Capgemini.

Comply with him on Twitter | LinkedIn

7. Bradley Leimer

Bradley Leimer is the Government Director and Head of Fintech Partnerships and Open Innovation at Sumitomo Mitsui Banking Company – SMBC Group. Beforehand, Bradley co-founded Unconventional Ventures, which connects founders to funders, supplies mentorship to entrepreneurs, advisory to corporates, and broadens alternatives for variety inside the ecosystem. Bradley writes and speaks about banking and expertise tendencies and advises corporates, startups, accelerators, and key business conferences within the monetary providers house.

Comply with him on Twitter | LinkedIn | Weblog

8. Brendan Miller

Brendan is the Chief Advertising and marketing Officer at Runa. Beforehand, Brendan was the Principal Analyst for Digital Enterprise & Funds at Forrester Analysis. He writes largely about retail, eCommerce, fintech, funds, and fintech innovation.

Brendan is enthusiastic about growing technique, positioning, branding, messaging, and campaigns that differentiate, reveal thought management, and end in income affect.

Comply with him on Twitter | LinkedIn

9. Brett King

Brett King is a world-renowned futurist and speaker, a world bestselling creator, and a media persona who covers the way forward for enterprise, expertise, and society. He has spoken in over 50 international locations, at TED conferences, given opening keynotes for Wired, Techsauce, Singularity College, Net Summit, The Economist, IBM’s World of Watson, CES, SIBOS, and lots of extra.

Brett has appeared as a commentator on CNBC, BBC, ABC, Fox, and Bloomberg. He beforehand suggested the Obama administration on fintech coverage and advises regulators and financial institution boards world wide on expertise transformation.

Comply with him on Twitter | LinkedIn | Web site or subscribe to his Breaking Banks podcast wherever you get your podcasts.

10. Brian Billingsley

Brian Billingsley is the president of Credova, the fintech division of PublicSquare. With over 15 years of expertise within the funds and fintech industries, and a background in cost consulting and strategic enterprise improvement, Brian has held roles at corporations equivalent to Klarna, Alliance Knowledge, and FIS.

Comply with him on Twitter | LinkedIn

11. Brian Shniderman

Brian Shniderman is the CEO and Managing Associate of 99FinTech, a particular administration consulting agency specializing in performance-based tasks that drive progress and operational excellence throughout monetary providers, together with industrial and retail banking, funds, lending, and fintech. With over 35 years of business expertise, Brian is devoted to serving to corporations unlock income progress, launch new merchandise and divisions, and develop into new markets.

A thought chief in funds and fintech, Brian has been featured within the Wall Avenue Journal, Forbes, Fortune, CNN, American Banker, the Enterprise Normal, Dow Jones, HBR, Wired, CIO, Bloomberg, the Boston Globe and the Chicago Tribune.

Comply with him on Twitter | LinkedIn

12. Christopher Danvers

Christopher Danvers has labored with credit score unions specializing in funds, digital transformation, and monetary expertise for over 20 years. He’s a daily speaker at business occasions, a contributor of editorial content material to business publications, and is taken into account an innovator and thought chief. Christopher is at the moment Senior Director, Head of Consumer Options – Neighborhood Issuer & Fintech at Visa.

Comply with him on Twitter | LinkedIn

13. Chris Gledhill

Chris Gledhill commonly ranks because the number-one prime world fintech influencer and infrequently speaks and writes about fintech, Banking, and the way forward for monetary providers. Chris was lead cell architect and led the disruptive innovation labs at Lloyds Banking Group earlier than turning into CEO and Co-Founding father of the fintech startup Secco.

Chris has each a technical and enterprise background with experience spanning a variety of disruptive applied sciences, together with blockchain, AI, API, huge knowledge, deep studying, digital actuality, crypto-currencies, biometrics, and cell and wearables.

Comply with him on Twitter | LinkedIn

14. Chris Skinner

Chris Skinner is called an unbiased commentator on the monetary markets and fintech by way of his weblog, theFinanser.com and because the creator of the bestselling books Digital Financial institution, ValueWeb, and its new sequel Digital Human. In his day job, Chris is chair of the European networking discussion board The Monetary Companies Membership, Chair of Nordic Finance Innovation, in addition to being a Non-Government Director of the fintech consultancy agency 11:FS.

Comply with him on Twitter | LinkedIn | Web site

15. Clint Wilson

A profitable fintech, software program, and funds entrepreneur, Clint was Group Chief Government of ParentPay from 2005 till March 2020. He was chargeable for establishing ParentPay because the UK’s main on-line cost service for colleges. Clint can also be the founding father of nimbl, ParentPay Group’s youth banking service.

Clint was an EY Entrepreneur Of The 12 months™ 2018 UK winner and in addition was awarded the accolade of the “UK’s Most Bold Enterprise Chief” in 2019 as a part of the Day by day Telegraph-backed LDC High 50.

Comply with him on Twitter | LinkedIn

16. Dave Heun

With over 30 years of expertise within the newspaper enterprise, Dave Heun at the moment works as an affiliate editor for Arizent, as a part of the PaymentsSource group. Dave writes in regards to the funds business, bank card business, cell pay applied sciences, and others. Comply with him to get all of the enter and study top-notch finest practices from the cost business.

Comply with him on Twitter | LinkedIn

17. Dave Maddox

Dave is blockchain’s go-to-market chief at IBM, the place he’s chargeable for IBM Blockchain Enterprise Growth for the Monetary Companies Market within the US with a give attention to blockchain enterprise options.

Dave has over 25 years of expertise within the info expertise business, the place he occupied govt roles in gross sales administration, enterprise improvement, and program improvement. As well as, he has deep data of the bank card cost Business and has written IBM papers analyzing the business for IBM’s Consumer Certification Program at Harvard College.

Dave’s specialties are blockchain expertise, cost processing methods, bank card methods, giant methods expertise, and transaction methods.

Comply with him on Twitter | LinkedIn

18. David Brear

David is a fintech pioneer and thought chief with over 15 years of expertise driving digital transformation and innovation for a number of the world’s largest monetary providers corporations. Because the CEO of 11:FS, a trailblazing consultancy, David helps purchasers craft forward-thinking methods, develop new propositions, and launch transformative ventures throughout the UK, US, Europe, and Asia.

Comply with him on Twitter | LinkedIn

19. Denise Bahs

Denise Bahs is the President of Spark Corp, the place she makes a speciality of lead technology by way of social media cyber sleuthing and engagement. She has educated a major variety of salespeople within the tech and funds business on methods to use social media and digital advertising to nurture their prospects by way of the client’s journey.

Comply with Denise on Twitter | LinkedIn

20. Devie Mohan

Devie is a fintech advertising technique and analysis skilled with years of expertise working with business giants and startups. She has labored in technique, advertising, and has held evaluation roles in companies like Goldman Sachs, Thomson Reuters, Ericsson, IBM, USAID, and SunTec.

Devie is a guide and researcher for a number of fintech startups, banking innovation teams, and traders, and has a eager understanding of the tendencies and actions of startups, banks, and traders within the house.

Comply with her on Twitter | Web site | LinkedIn

21. Efi Pylarinou

Efi Pylarinou is a seasoned Wall Avenue skilled and ex-academic who has grow to be a number one fintech and tech thought chief, trusted by world manufacturers in tech and monetary providers. Efi is a website knowledgeable with a Ph.D. in finance, a prolific content material creator, a number, an creator, and a speaker centered on innovation in monetary providers. Efi additionally served on the college at The Quick Future Government, lecturing stay on the way forward for finance and cash.

Comply with her on Twitter | LinkedIn

22. Erin McCune

Erin is a associate at Bain & Firm, the place she contributes to payments-related tasks for a wide range of Bain purchasers.

Erin has over 20 years of expertise main more and more complicated cost initiatives for company purchasers, in addition to advising monetary establishments and cost technologists on the event of their cost capabilities. Earlier than becoming a member of Glenbrook, Erin was the founding father of Forte Monetary, a consulting agency.

Erin’s specialties are funds methods, monetary course of enchancment, alternative evaluation, build-buy-partner evaluation, market sizing, aggressive intelligence.

Comply with her on Twitter | LinkedIn

23. Florian Graillot

Florian is a VC investor and Founding Associate at astoryaVC and has invested in early-stage startups in Europe with a give attention to applied sciences that might construct the subsequent insurance coverage technology. He’s an engineering graduate from Telecom ParisTech and a enterprise faculty graduate from HEC Paris. Florian commonly writes and tweets about InsurTech, AI, and startups.

Comply with him on Twitter | LinkedIn

24. Gareth Lodge

Acknowledged globally as an knowledgeable in all the things associated to funds, Gareth Lodge supplies his purchasers actionable insights and evaluation by way of his analysis, consulting, and talking.

He’s at the moment a funds Senior Analyst and International Lead at Celent, a analysis and advisory agency, specializing in monetary providers. He usually shares insights into how a financial institution processes funds (cost hubs and engines), and the way they transfer and settle funds (ACH, wire, real-time funds, Swift).

Gareth can also be a well known speaker and contributor within the funds house, together with retail, company, and card funds, having spoken at occasions equivalent to Sibos, EBAday, Nacha, and Money2020.

Comply with him on Twitter | LinkedIn

25. Ghela Boskovich

Ghela is a self-proclaimed fintech fanatic and Founding father of FemTechGlobal™, a community devoted to difficult the established order, and enhancing the inclusiveness and variety in monetary providers. Frequent keynote speaker and editorial contributor, Ghela focuses on methods to fast-track inner innovation, specializing in the sensible utility and commercialization of fintech/financial institution collaboration.

An advocate of nurturing Buyer Lifetime Worth for each banks and people they serve, Ghela is a confirmed evangelist for adopting expertise to remodel the monetary providers business for the larger good.

Comply with her on Twitter | LinkedIn

26. Ian Rutland

Ian Rutland is the Strategic Advisor at Advantio, one in all Europe’s main cyber safety specialists working from workplace places within the UK, Eire, Bulgaria, and Sweden. With over 30 years of expertise, Ian is a famend voice within the funds and fintech industries with world expertise throughout the funds worth chain.

Comply with him on Twitter | LinkedIn

27. James Wester

James Wester is a analysis and technique analyst with greater than three a long time in analysis, product administration, and advertising for a wide range of expertise and cost corporations.

He’s at the moment main analysis protection of cryptocurrencies and digital belongings for Javelin Technique and Analysis, together with subjects like central financial institution digital currencies (CBDCs), stablecoins, tokenized belongings, and extra. James is a frequent worldwide speaker quoted within the New York Occasions, Wall Avenue Journal, Market, CNBC, the Economist, and lots of others.

Comply with him on Twitter | LinkedIn

28. Jason Mikula

Jason Mikula is guide specializing in early stage fintech corporations, in addition to a seasoned investor and advisor. With a wealth of expertise spanning each startups and conventional monetary establishments, Jason leverages his deep business data and community to publish a weekly publication and podcast protecting the newest in fintech, cryptocurrency, and banking.

Jason is the Head of Business Technique, Banking and Fintech at Taktile and the Founding father of Fintech Enterprise Weekly, a weekly in-depth evaluation of tendencies and enterprise fashions in banking and fintech.

Comply with him on Twitter | LinkedIn

29. Jim Marous

Jim Marous is taken into account one of many prime 5 most influential individuals in banking and also called probably the greatest keynote audio system at business and company occasions. Identified for his understanding of the disruption within the banking business, Jim is the co-publisher of The Monetary Model and proprietor and writer of the Digital Banking Report. Jim speaks on innovation, digital transformation, buyer expertise, advertising methods, channel distribution, funds, and alter administration.

Comply with him on Twitter | LinkedIn | Web site

30. Jordan McKee

Jordan McKee is the pinnacle of the fintech analysis and advisory group at S&P International Market Intelligence. He leads a workforce of analysts primarily based in North America, Europe, and Asia that gives steering on monetary expertise market alternatives and techniques. His fundamental pursuits embody digital transformation methods for cost networks, issuing and buying banks, cost processors, point-of-sale suppliers, and different funds business stakeholders.

Jordan was listed on the Digital Transactions Affiliation‘s Forty Beneath 40 listing in 2018. He’s ceaselessly engaged by the media to share his insights and has been quoted within the Wall Avenue Journal, the New York Occasions, Forbes, TIME, Businessweek, and The Monetary Occasions, in addition to a fintech contributor at Forbes.

Comply with him on Twitter | LinkedIn

31. JP Nicols

JP Nicols is a trusted advisor to corporations starting from startups to the Fortune 500 in addition to a preferred author and top-rated speaker.

He’s the Co-Founding father of Alloy Labs, an ecosystem of neighborhood and mid-size banks working collectively to develop insights that drive partnerships, product improvement, and strategic investments to raised serve evolving buyer wants and assist them compete and win in a quickly altering world. JP is usually quoted within the media, and his title commonly seems on a number of lists as an influential thought chief, however what actually drives him helps individuals flip concepts into outcomes.

Comply with him on Twitter | LinkedIn | Web site

32. Karen Webster

Karen Webster is among the world’s main specialists on rising funds and a strategic advisor to CEOs and boards of multinational gamers within the funds and commerce house. Because the CEO of Market Platform Dynamics, she works extensively with probably the most modern gamers within the funds, monetary providers, cell, B2B, digital media and expertise sectors to determine, ignite, and monetize innovation.

Karen serves on the boards of a number of rising corporations, serving to innovators develop and implement enterprise methods that drive market adoption for his or her services and products. She’s additionally the founding father of PYMNTS.com, the business’s main B2B advertising platform.

Comply with her on Twitter | LinkedIn

33. Kate Fitzgerald

Kate Fitzgerald is a enterprise journalist with huge expertise in monetary providers and retail, notably funds, emphasizing rising digital and cell cost expertise, apps, chatbots and associated improvements.

She is a senior editor at American Banker, the place she shares information and evaluation concerning the digital funds revolution. Previous to her expertise at American Banker, Kate held the function of Rising Funds Editor at FinTech Futures.

Comply with her on Twitter | LinkedIn

34. Marcel van Oost

Marcel describes himself as an advisor, investor, and connector inside the fintech business. He started his profession at an buying financial institution earlier than founding his personal cost service supplier. Marcel is well-known for his every day fintech publication, FinTech Europe, and podcast, Connecting The Dots, the place he shares insights and connects the dots throughout the business.

Comply with him on Twitter | LinkedIn

35. Matt Oppenheimer

Matt is the co-founder and CEO at Remitly, a cell funds service that permits customers to conveniently make person-to-person worldwide cash transfers. The corporate’s imaginative and prescient is to remodel the lives of hundreds of thousands of immigrants and their households with one of the trusted monetary providers merchandise on this planet.

Earlier to his expertise at Remitly, Matt was the Head of Cellular and Web Banking Initiatives at Barclays Financial institution Kenya, the place he led the launch of the primary web banking platform for Barclays Financial institution Kenya.

Comply with him on Twitter | LinkedIn

36. Michael Diamond

Michael Diamond is the Senior Vice President and Basic Supervisor of Digital Banking at Mitek Programs. Michael has been within the tech business for many of his profession and has labored by way of varied arcs of interactive banking expertise, together with interactive voice response, on-line banking, cell banking, cell funds, and eventually, cell test deposit.

When he isn’t working, Michael enjoys writing and public talking, and he’s enthusiastic about management and innovation, which he writes about on his weblog, michaeldiamond.com.

Comply with him on Twitter | LinkedIn | Web site

37. Nadja Bennett

Nadja has over 13 years of expertise within the cost and fraud business, each in buying and gateway processing. Her experience lies in funds, eCommerce, fraud, fintech, unified commerce, omnichannel, and multinational commerce.

Comply with her on Twitter | LinkedIn

38. Neira Jones

Neira Jones has greater than 25 years of expertise in monetary providers and expertise. She is commonly invited to advise organizations of all sizes on funds, cyber-crime, crypto-currency and blockchain, info safety, rules (e.g. PSD2, GDPR, and so forth.) and on digital innovation, the place she strives to demystify the hype surrounding expertise at this time.

Comply with her on Twitter | LinkedIn

39. Nick Bilodeau

Nick Bilodeau is a monetary providers govt and a acknowledged business influencer with over 20 years of management expertise. His work has included heading advertising and product improvement throughout the funds, banking, insurance coverage, and wealth administration industries. He’s at the moment the Government Director of Quantum.

Comply with him on Twitter | LinkedIn

40. Nicole Baxby

Nicole Baxby is the Vice President of Buyer Success at Quantifind, the AI-powered threat intelligence firm that helps organizations detect and mitigate threat with larger accuracy and pace. Nicole has 20 years of expertise within the fintech business, and her space of experience consists of buyer success, funds, and world fintech.

Comply with her on Twitter | LinkedIn

41. Nik Milanović

Nik Milanović has spent most of his profession in monetary expertise and microfinance, main technique and partnerships at a number of fintech corporations. He’s now the founding father of the favored fintech publication This Week in Fintech, an advisor, and the founding father of The Fintech Fund, an early-stage enterprise capital fund.

Comply with him on Twitter | LinkedIn

42. Oliver Bussmann

Oliver Bussmann is a Senior Expertise Government with 30+ years of influential management in several high-tech and finance providers industries with UBS, SAP, Allianz, Deutsche Financial institution, and IBM.

Oliver is a thought chief in fintech, blockchain, enterprise mobility, and cloud computing, in addition to a pioneer in recognizing tendencies and using business-building social media methods from the CXO function.

Comply with him on Twitter | LinkedIn | Web site

43. Patricia Hines

Patty Hines has over 20 years of expertise in monetary providers throughout enterprise, expertise, and operations. Her areas of experience embody corporate-to-bank integration, on-line money administration, supply channels, and buyer relationship administration, together with end-to-end industrial and small enterprise lending.

Comply with her on Twitter | LinkedIn

44. Ron Shevlin

Ron is the Chief Analysis Officer of Fintech Analysis at Cornerstone Advisors. A sought-after keynote speaker, he’s broadly thought to be a thought chief in banking and fintech. Ron is a daily contributor to Forbes and has authored a number of books on fintech.

Comply with him on Twitter | LinkedIn

45. Sebastien Meunier

Sebastien is a technique guide and knowledgeable within the administration of world transformations in monetary establishments. His two key areas of focus are enterprise effectivity and innovation in finance, and he helps banks rework their companies, be extra environment friendly at each degree whereas adapting to the fintech increase.

Comply with him on Twitter | LinkedIn

46. Simon Taylor

Simon Taylor is the Founding father of International Digital Finance and Fintech Brainfood, in addition to the Head of Technique and Content material at Sardine. Simon has been immersed within the expertise of economic providers for his complete profession and is persistently voted one of the influential individuals in banking, insurance coverage, and fintech by banks, his friends, and numerous business our bodies.

Comply with him on Twitter | LinkedIn

47. Spiros Margaris

Enterprise capitalist and advisor Spiros Margaris is the founding father of Margaris Ventures, and one of many foremost world thought leaders and specialists within the fields of fintech and insurtech. He’s the primary worldwide influencer to attain “The Triple Crown” of influencer rankings by being ranked the worldwide No. 1 fintech, synthetic intelligence (AI), and blockchain influencer by Onalytica in 2018.

Having launched two startups in New York, together with a pioneer in what would now be termed fintech, Spiros believes that his banking, cash administration, and entrepreneurial expertise assist him higher perceive the challenges that the monetary business faces and thus in a position to devise and help modern options for them. He’s a frequent speaker at worldwide fintech and insurtech conferences, and publishes articles on his innovation proposals, inspirations, and thought management.

Comply with him on Twitter | LinkedIn

48. Susanne Chishti

Susanne Chishti is the Chair of FINTECH Circle, Europe’s first investor community centered on fintech investments and a number one fintech innovation, studying, and communications platform. She can also be a Non-Government Director at Crown Brokers Financial institution (CAB Funds PLC) and the Chair of the ESG Sub-Committee. In 2024 Susanne was chosen among the many High 100 Girls in fintech globally.

She can also be the Co-Editor of the bestseller The FINTECH Ebook, which has been translated into ten languages and is offered throughout 107 international locations.

Comply with her on Twitter | LinkedIn

49. Theodora Lau

Theodora Lau is a public speaker, author, and advisor whose work goals to ignite innovation in each the private and non-private sectors, with a give attention to uplifting underserved demographics and fostering a extra inclusive society. Theodora is the founding father of Unconventional Ventures, an initiative devoted to constructing and nurturing an ecosystem of economic establishments, firms, startups, entrepreneurs, enterprise capitalists, and accelerators to deal with the unmet wants of customers, particularly ladies and underrepresented founders.

Comply with her on Twitter | LinkedIn

50. Todd Ablowitz

Todd is a globally acknowledged and sought-after authority on cost expertise, cell funds, and rising funds tendencies. For over 20 years, he has helped tons of of software program corporations, sponsors, and banks throughout the globe navigate the complexities of the funds business. Todd has developed methods primarily based on tendencies and market calls for, created and launched new merchandise, and constructed and led profitable gross sales organizations. Consequently, traders, analysts, and business watchers ceaselessly depend on Todd for knowledgeable recommendation, development insights, and consulting on funds and funds improvements.

Comply with him on Twitter | LinkedIn

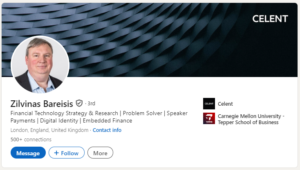

51. Zilvinas Bareisis

Zilvinas Bareisis is the Head of Retail Banking and Funds Analysis at Celent, the place his analysis is concentrated on retail banking applied sciences with a specific emphasis on shopper and card-based funds and identification and authentication. Zilvinas has over 20 years of expertise advising senior executives at main monetary establishments and their expertise and repair suppliers.

He has a eager curiosity in funds innovation and the way the “good storm” of aggressive, regulatory, and expertise developments shapes shopper funds within the current and future.

Comply with him on Twitter | LinkedIn

We hope this rigorously curated listing of funds and fintech specialists serves as a helpful useful resource in your journey by way of the dynamic world of funds. Whether or not you’re embarking on new ventures or just on the lookout for contemporary insights and techniques, following these thought leaders will hold you knowledgeable of the newest tendencies, business finest practices, and rising improvements.

However we need to hear from you, too! Are there different specialists you’re following who needs to be included on this listing? Share your suggestions within the feedback beneath.

And when you’re desirous to dive deeper into the world of on-line funds, don’t miss our complete On-line Cost Processing Information, filled with important ideas and insights to optimize your eCommerce cost technique.