Retail tech has come some distance for the reason that invention of money registers. One point-of-sale gadget can now set up stock, observe gross sales, and settle for bills — all at the pass with one POS terminal. Affordable cellular terminals additionally permit companies to evolve to the repeatedly evolving in-person cost strategies similar to purchase now, pay later (BNPL) and QR codes.

To carry you insights into this fashionable cost era, I leveraged my seven years of enjoy reviewing POS methods and cost methods, my level in monetary control, and certificates bills era.

What is a POS Terminal?

Some extent-of-sale, or POS terminal, is a compact trade {hardware} that includes integrated POS device and a card reader to just accept coins, card, and different varieties of non-cash transactions like present playing cards. Terminals additionally in most cases have, or are attached to, cloud-based POS device to replace trade data similar to stock ranges and gross sales in real-time.

History of Cash Registers and POS Systems

Before the POS terminal, there was once the money check in. Invented by way of James Ritty, a saloon proprietor from Ohio, in 1879, the money check in was once designed to as it should be document transactions to lend a hand customers with their bookkeeping.

The National Cash Register (NCR) in the end bought the discovery in 1884. During this time, electrical motors, coins drawers, and paper rolls for receipts had been added to the money check in.

Did you recognize? Tech monopolies aren’t only a Twenty first-century drawback. In 1921, the U.S. Government filed fits in opposition to NCR beneath the Sherman Antitrust Act. At the time, NCR managed 95% of the money check in marketplace.

IBM offered the primary eating place computer-based POS gadget in 1973, which got here with an digital coins check in (ECR) and a client-server at the again finish. But it wasn’t till 1979 that Visa and Mastercard launched the magstripe era for accepting bank card bills on the level of sale.

When the web turned into to be had, Europay, Visa, and Mastercard additionally evolved EMV chips on bank cards in 1993, considerably making improvements to bank card processing. Soon after, pioneers like PayFriend, Verifone, and Ingenico evolved cellular card readers, permitting companies to just accept bills anyplace.

Eventually, PayFriend transitioned clear of its elementary cellular card readers and, together with different competition like Square, offered POS terminals that supply higher safety and extra complicated cost functions. As POS era complicated, main cost processors introduced what are actually referred to as “Smart Terminals” that blended complicated POS options.

How can POS terminals reinforce trade operations?

The creation of the web enabled POS methods and terminals to adapt right into a extra environment friendly trade resolution. Nowadays, terminals be offering faster and extra protected cost processing, buyer engagement equipment, higher stock keep watch over, and further cost channels.

Read extra: Best POS methods for small trade

How do POS terminals paintings?

The function of the POS terminal within the POS ecosystem is to compute the whole price of the transaction, settle for cost, and stay a document of the transaction.

During checkout

At checkout, consumers carry merchandise to the POS terminal for acquire. The dealer scans the product barcode with a barcode scanner, which generates a corresponding SKU quantity inside the POS gadget’s stock catalog. The product data, together with the record worth, is then displayed, and the consumer enters the amount to get the whole price.

When accumulating cost

Once the whole worth is displayed, the buyer gifts their most well-liked cost means.

- If coins or different non-card bills: The dealer enters the gentle quantity to advised the money drawer.

- If card: the vendor will both swipe, insert, or faucet the cardboard within the house the place the cardboard reader is situated within the POS terminal.

- If cellular and different virtual cost: the buyer will provide evidence of cost on their cellular instrument for the consumer to document the affirmation code

In the again finish, a cost authorization request is initiated at this level. The transaction and cost knowledge is encrypted and transmitted by way of the service provider’s cost processor, then despatched to the related monetary establishments for verification. If the buyer’s financial institution confirms that price range are to be had, the transaction will probably be licensed, and cost approval will probably be displayed at the POS terminal. Otherwise, a declined cost understand will probably be displayed, and the buyer will probably be requested to offer a special cost supply.

Logging the transaction

Finally, a receipt for the finished transaction will probably be generated and equipped to the buyer. A duplicate of the receipt is stored by way of the consumer. For card transactions, a transaction receipt is generated in triplicate, and one is given to the buyer. At the again finish, the POS gadget additionally data the sale and adjusts the to be had stock in real-time.

Read extra: POS deployment tick list

What are the important thing options to search for in a POS terminal?

The POS terminal is a mix of device and {hardware} parts.

Hardware setup

Hardware is an crucial function of a POS terminal. For it to finish its activity, the POS terminal will have to have, at minimal:

- A pc-operated instrument that runs the POS device.

- A card reader for accepting card bills (swipe, faucet, or dip).

- A thermal printer to generate receipts, or different way of turning in receipts.

You may additionally need to believe:

- A barcode scanner to scan barcodes that attracts up product data.

- A coins drawer (for countertop terminals) for storing coins and different non-card bills should you plan to just accept coins.

Payment gateway

The cost gateway is a device element embedded within the POS gadget. This is the checkout window at the gadget show the place the consumer enters the buyer’s cost data. The cost gateway will show the to be had cost strategies relying to your cost processing settings. It may be the cost gateway’s function to encrypt the transaction knowledge ahead of sending it to the cost processor for authentication.

Payment processor

The cost processor connects to the cardboard community and different monetary establishments that authorize the switch of price range from the buyer’s supply to the service provider. Payment processors are built-in into the POS terminal and be offering equipment for processing playing cards, ACH, virtual tests, contactless bills, and extra.

Inventory control

Inventory control is a number one function of a POS gadget and key to an effective POS terminal. The gadget straight away updates stock ranges with each and every transaction finished, returned, or refunded from the POS terminal. Constant stock tracking is helping save you stockouts.

Transaction reporting

One of the principle purposes of a easy coins check in is to stay gross sales data. With a contemporary POS gadget, each and every transaction finished in a POS terminal no longer handiest data the sale but additionally generates buyer profiles and updates to be had stock. It can categorize transactions in more than one techniques, similar to by way of worker, checkout counter, buyer, product, and extra.

Loyalty and rewards

While no longer a key element, a loyalty and rewards program built-in into the POS gadget can considerably reinforce buyer relationships. With this selection, a service provider can additional analyze buyer buying behavior and create adapted campaigns that consumers will need to take part in. This is helping companies to construct a cast buyer base and stay them engaged.

Top POS terminals in 2024

With all of the POS methods and terminals in the marketplace as of late, opting for the most suitable choice for what you are promoting can also be difficult. Below, I come up with our most sensible POS terminal suggestions for fashionable trade sorts:

Square Terminal

The Square Terminal is Square’s all-in-one cellular POS terminal. It comes with integrated POS device that may paintings as a stand-alone or as a 2d display to the Square Register and a integrated card reader for swipe, EMV chip, and NFC contactless transactions. What’s nice about Square is that it gives industry-specific POS device that may be put in into the Square Terminal at no further price. Though no longer optimized for lengthy hours of hand-held cost processing, the Square Terminal is compact sufficient for accepting bills table-side and for simple setup in farmers markets and popup shops.

Specifications:

- Price: $299 or $27/mo for 365 days

- Warranty: One-year restricted guaranty, 30-day unfastened go back

- Payments permitted: Chip playing cards (EMV), NFC playing cards, Apple Pay, Google Pay, Samsung Pay, Afterpay, Cash App Pay (QR code), Magnetic-stripe playing cards with unfastened magstripe reader plug-in

- Offline cost to be had

- Connectivity: Wifi, Ethernet

- In the field:

- Square Terminal {hardware}

- Power adapter

- Power adapter cable

- Receipt paper roll

- Accessories:

- Hub for Square Terminal

- Additional paper rolls

- Hardware: White, made from steel and molded plastic, weighs 417g, 5.6in L x 3.4in W x 2.5in H

- After-sale toughen: 24/7

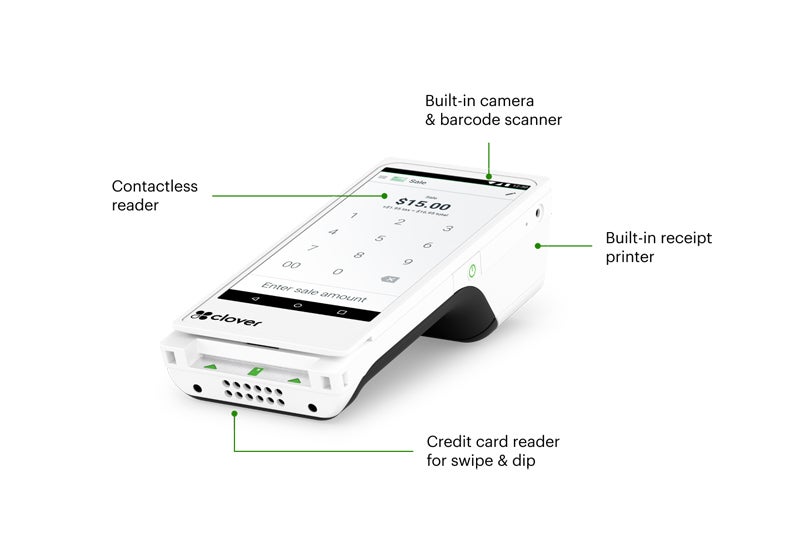

Clover Flex

The Clover Flex is a swish and transportable POS terminal designed for hand-held transactions. It is provided with a 6-inch colour touchscreen and integrated digicam, receipt, and barcode scanner. The Clover Flex additionally has an embedded magnetic stripe, EMV chip, and NFC contactless reader to procedure bills. Merchants should buy this without or with POS device, however you’ll want the device should you intend to make use of the Flex as an extension of a countertop POS gadget. The Clover gadget is exclusive as it’s suitable with various cost processors.

Specifications:

- Price: $599 or $35/month

- Warranty: One-year restricted guaranty

- Payments: Accepts chip, swipe, and contactless bills like Apple Pay®, Google Pay, and Samsung Pay®

- Display: 6″ LCD colour contact display

- Camera/Scanner: 1D/2D barcode scanner/digicam

- Receipt printer: Built-in thermal dot receipt printer

- Security: Clover Security end-to-end encryption

- Connectivity: Wi-Fi and LTE connectivity

- Battery existence: 8 hours for same old SMB

- After-sale toughen: 24/7

- Purchase choices:

- Flex Pocket (with out integrated receipt printer)

- Clover POS device (retail or eating place) at $14.95 or $49.95 per thirty days

- In the field:

- Clover Flex {hardware}

- Charging cradle

- Power twine

- Power brick (battery)

- Optional PIN access support

- One roll of receipt paper

- Quick get started information

Toast Go2 hand-held POS

Toast’s hand-held instrument is a stand-alone POS and cost terminal with integrated POS device, a card reader, and receipt printer. The {hardware} is industry-grade, with IP54 coverage in opposition to mud and water injury, and constructed to resist drops as much as 4 toes. Ideal for busy sit-down eating places, the Toast Go2 comes with desk seating and reservation control equipment, plus customized tipping, invoice splitting, and signature seize options.

Specifications:

- Price: Startup package $0 or $494.10 + $50/mo

- Warranty: One-year restricted guaranty

- Payments: Accepts NFC, EMV, and conventional MSR bank cards, Apple Pay, Google Pay, and different contactless bills

- Durability: Restaurant-grade. Dropproof as much as 4 toes, IP54 rated for mud and water resistance

- Display: 6.4-inch touchscreen

- Dimensions: 7.87” L x 0.79” W x 3.74″ H

- Product Weight: 1.13 lbs

- Battery existence: Up to 24 hours

PayFriend Terminal

The PayFriend Terminal is a stand-alone POS {hardware} designed in a similar fashion to Square Terminal. However, {hardware} equipment like barcode scanners, thermal printers, and charging docks are not obligatory. The PayFriend Terminal comes with a integrated card reader able to faucet, EMV chip, and contactless bills and PayFriend’s POS device. The starter package additionally features a preloaded SIM card for persisted web get admission to and uninterrupted cost processing. The PayFriend Terminal is perfect for promoting in farmers’ markets, business presentations, and popup shops that cater to vacationers who pay with world bank cards.

Specifications:

- Price:

- Basic PayFriend Terminal: $199

- With barcode scanner: $239

- Accessories:

- Printer and magnetic charging dock: Plus $70 (with elementary Terminal) or Plus $60 (with Terminal and barcode scanner)

- Warranty: One-year restricted guaranty, 30-day go back

- Payments: Chip, faucet, PIN, and NFC bills

- Battery existence:

- Standby – Up to 48 hours

- Operational – Up to twelve hours

- With Zettle Printer & Dock – consistent

- Dimensions: 5.4in L x 3in W x 0.6 in H

- Weight: 210 grams

- Connectivity: WiFi, 3G/4G

- Dark grey, made from steel and molded plastic

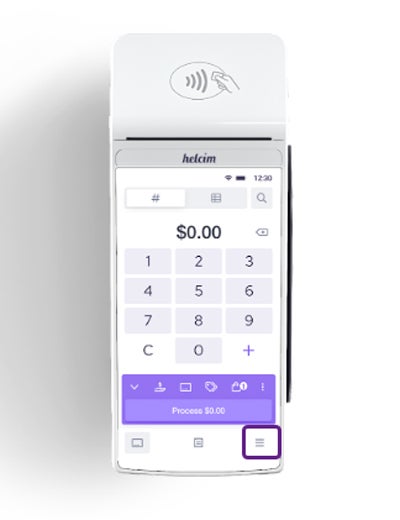

Helcim Smart Terminal

The Helcim Smart Terminal comes with stand-alone POS device, a coloured contact display show, and a integrated receipt printer. It connects to the web by means of WiFi and accepts card and virtual pockets bills by means of faucet, chip, and PIN. It too can settle for bills for Helcim invoices by means of handbook card access. The instrument lacks a digicam or barcode scanner, so it’s higher fitted to skilled products and services and eating places than retail. But what makes Helcim Smart Terminal stand out is its pre-approved and integrated surcharging function, which you’ll be able to toggle off and on for each and every transaction.

Specifications:

- Price: $329 or $30 for 365 days

- Accessories: Charging dock $50

- Payments: Accepts chip, faucet, PIN, and contactless bills like Apple Pay®, Google Pay

- Warranty: One-year restricted guaranty, 14-day go back

- Connectivity: WiFi

- Dimensions: 7.87in L x 3.07in W x 2.20in H

- Weight: 1.1 lbs

- In the field:

- Helcim Smart Terminal

- Charging Cable (USB-C to USB-A)

- Additional USB-C Cable

- Receipt paper rolls x2

How do you select the correct POS terminal for what you are promoting?

The proper POS terminal for what you are promoting relies on your wishes and the combo of {hardware}, cost processing, and device that can absolute best fit your needs.

Unlike 10 or 15 years in the past, when companies needed to come to a decision whether or not they sought after an on-premise or cloud-based POS, as of late, maximum POS methods solely be offering cloud setups. However, believe the next components when opting for a POS terminal for what you are promoting:

Available cost strategies

The absolute best POS terminal will have to toughen all primary bank cards and virtual bills. It will have to additionally be capable to settle for some other cost strategies you wish to have to toughen, together with present playing cards, keyed-in bills, and purchase now, pay later (BNPL) installment choices. The proper cost processor will even supply you choices to make use of price optimization techniques similar to surcharging and comfort charges to attenuate your processing prices.

Read extra: Best service provider products and services

Fees

Speaking of processing prices, cost processing charges are arguably essentially the most major factor when opting for a POS terminal. Hardware prices for cost processing range from unfastened to loads of greenbacks, relying on what you are promoting wishes. However, habitual prices for accepting bills will impact your income essentially the most. Choose a supplier that gives you essentially the most financial savings according to your gross sales quantity. Make certain that you simply handiest pay for cost processing options that you simply recently want.

Security

Regardless of what you are promoting dimension or {industry}, transaction safety will have to be a big attention as you deal with delicate buyer data. To reduce safety dangers, paintings handiest with stage 1 Payment Card Industry (PCI) approved cost processors. This guarantees that your supplier gives the most recent safety features, similar to end-to-end encryption, consumer authentication, device studying fraud detection, and chargeback control equipment.

Read extra: Guide to POS safety

Available integrations

Your POS terminal will have to have get admission to to key functionalities similar to stock, Jstomer dating control (CRM), loyalty and rewards, and reporting. You will have to additionally search for different third-party integrations for equipment you could want, similar to accounting and native supply. Being ready to combine these kind of options into one platform is helping in developing an effective trade control resolution.

Connectivity

A competent POS terminal remains attached and works successfully with minimum downtime or failed transaction requests. For this, you want to make a choice a cost terminal {hardware} with more than one connectivity choices similar to Bluetooth, WiFI, and LAN, in addition to transient offline cost processing all over an influence outage. Also, believe the terminal’s energy supply and battery existence in opposition to your conventional trade day and transaction quantity.

Industry-specific options

Industry-specific options additionally play a task in cost terminals. In reality, the early eating place POS terminals already had a kitchen ordering integration. Currency conversion may be one of the most early options permitting traders to just accept world bills.

Look for any industry-specific equipment what you are promoting wishes ahead of opting for a POS terminal. For instance, elementary and customized tipping is to be had from some cost processors. While eating places choose native supply capability, a store may desire a transport function as an alternative.

No Comment! Be the first one.