As an ecommerce enterprise proprietor, you’ve a wide range of tax duties, and these will range relying on the place your on-line retailer operates. However of all of the ecommerce tax obligations you must take care of, the one which requires essentially the most consideration is gross sales tax.

Earnings taxes and numerous different taxes are comparatively easy to know in comparison with gross sales tax. They’ll nonetheless be troublesome to work by way of, however with an excellent tax accountant or bookkeeper, you possibly can coast by way of it. However gross sales tax? This one requires extra consideration to maintain up with it.

The excellent news is, when you’re having to take care of troublesome ecommerce gross sales tax points, which means your annual gross sales are rising! So whereas it’s true you need to make investments fairly a little bit of effort to correctly handle gross sales taxes, in some ways it’s an excellent downside to have. In any case, when you didn’t owe any gross sales taxes, which means you made no gross sales.

Earnings tax is, by comparability, comparatively easy. Right here’s your income. There’s your enterprise bills. That is your revenue. Use this tax charge to do the tax calculation. Achieved.

However ecommerce gross sales tax has many extra elements at play than with a standard brick and mortar retail location. Listed here are just a few of the most important challenges you must take care of:

International locations

Every nation has its personal gross sales tax charges and processes. Some have extra useful authorities techniques than others. In case your ecommerce enterprise sells merchandise in a number of international locations, you’ll must work out the gross sales tax particulars for every of them.

US states

In america, for some time, on-line companies received away with charging no gross sales tax. These days are over. And now, as a substitute of only one nationwide tax charge, each state has its personal. Some states cost no gross sales taxes. Others have completely different charges relying on cities and counties.

With 50 states, when you’re promoting throughout the entire nation, you must adjust to 50 completely different state gross sales tax necessities.

Ongoing duties

In contrast to revenue tax, which occurs simply annually for most individuals, gross sales tax is unending. Each transaction, you must gather tax. And what you cost the shopper will change relying on the place your enterprise is situated, the place the shopper is, and typically different elements, too.

Altering legal guidelines

Completely different states have grappled with the problem of digital gross sales taxes in numerous methods. And people methods don’t at all times stay the identical. With elected officers coming and going, completely different attitudes about on-line enterprise, and the notion of lacking tax income for governments, gross sales tax legal guidelines relating to digital transactions change much more typically than for companies with bodily areas.

Exempt gadgets

Some merchandise qualify for gross sales tax exemptions. However once more, it isn’t universally agreed upon which gadgets ought to qualify. For instance, some states exempt female hygiene merchandise, however others don’t. And these exemptions also can change. In case your on-line retailer sells a wide range of gadgets, some may require no gross sales tax, in some locations. For now.

With all these challenges, the place do you start?

Let’s begin on the nation degree.

At present, the most important distinction between america and European international locations is the VAT — the value-added tax. About 170 international locations, together with the European Union, cost a VAT as a substitute of a gross sales tax. The 2 sorts of taxes operate equally by way of the income they generate, however the course of for the way they work is kind of completely different.

Worldwide ecommerce tax — VAT

What’s VAT? The thought with a value-added tax is that the tax will get utilized at every stage of manufacturing.

Think about an ecommerce enterprise promoting natural shake mixes. The enterprise works with a manufacturing facility to fabricate and package deal their product. The manufacturing facility works with worldwide meals distribution corporations. The meals distribution corporations work with farmers on the supply.

With a value-added tax, every of those hyperlinks within the chain pays a portion of the tax owed. And by the point it will get to the buyer, they pay the mixed whole of all of the taxes paid alongside the best way.

Who has to pay the VAT?

Each nation costs its personal VAT.

In case your ecommerce enterprise sells merchandise in a rustic that makes use of a VAT, you must gather taxes and remit them to that nation’s authorities. For some international locations, there could also be substantial gross sales thresholds that decide which companies have to pay. This is called a registration threshold. A small enterprise proprietor is likely to be exempt.

However for international locations the place you’ve a everlasting institution, the edge now not applies and you’re required to pay the VAT. Some say a VAT is less complicated than a gross sales tax, however not everybody agrees.

What are the VAT charges?

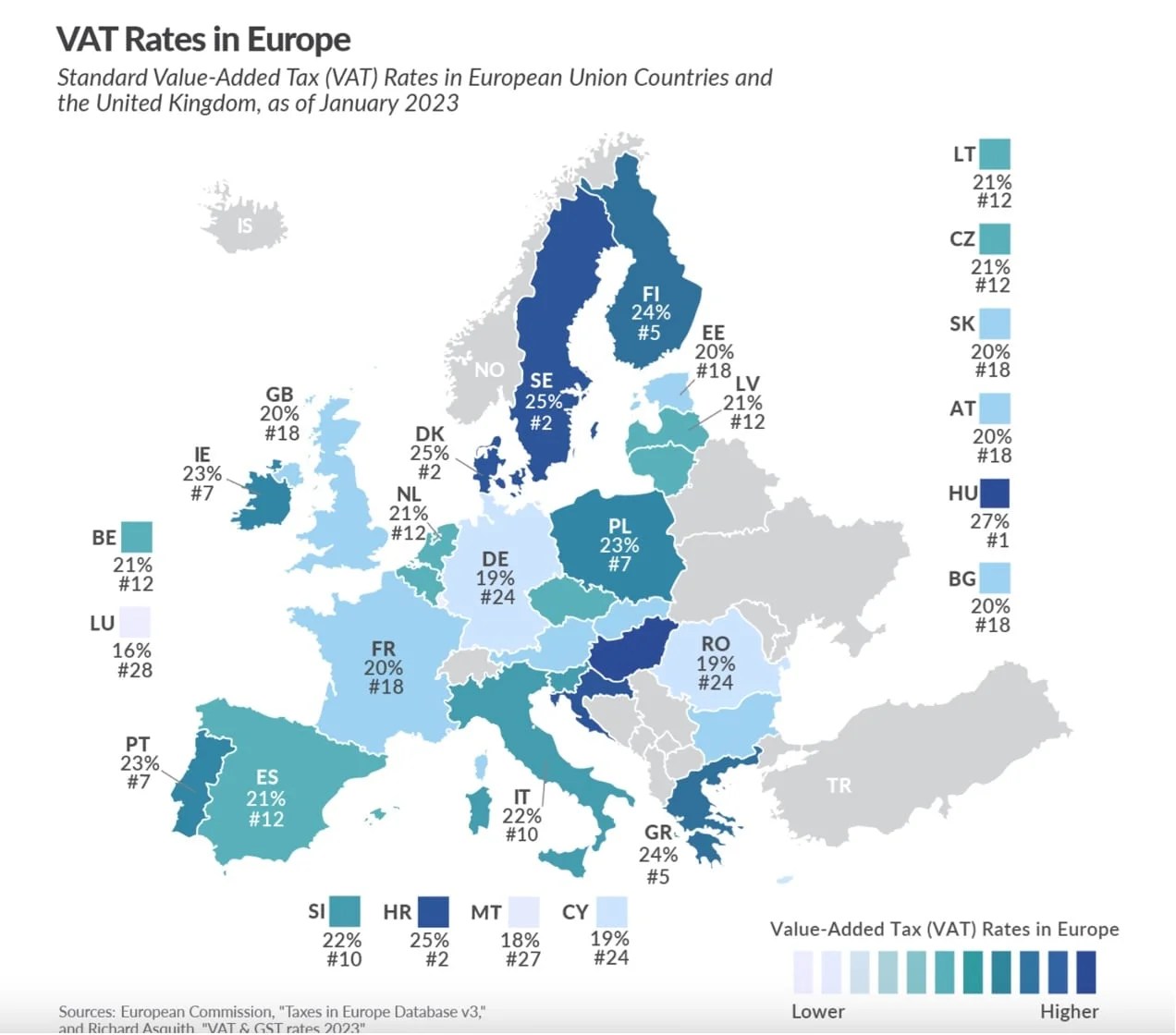

As you might need guessed — it’s sophisticated. Every nation costs its personal VAT charges. And people charges won’t be constant relying on the merchandise offered and numerous different elements. For instance, Poland’s predominant VAT charge is 23%, however it’s decrease in sure conditions resembling meals merchandise.

Right here’s a map of Europe exhibiting what every nation costs for VAT.

How does my ecommerce enterprise pay the VAT?

To adjust to VAT necessities, first your enterprise must register with every nation by which it does sufficient enterprise to satisfy minimal thresholds.

Then, arrange your bookkeeping software program so it calculates the tax charges charged by every nation the place you may be paying a VAT.

Final, get your bookkeeping software program to combine along with your ecommerce platform so your clients can be charged the right VAT charge on the level of sale. That means that you can gather taxes owed, and from there you’ll be capable to calculate what you owe to the assorted international locations, and remit it to them.

US ecommerce tax — gross sales taxes

The US makes use of gross sales taxes as a substitute of value-added taxes. A gross sales tax costs the shopper a proportion of the acquisition quantity on the level of sale. Then, the enterprise remits the tax to the related governing authorities, which might be states, cities, or counties. Or all three.

It differs from a VAT in that the enterprise promoting the product to the shopper is chargeable for paying the complete gross sales tax. With a VAT, that enterprise can write off the parts of the tax which have already been paid by different companies earlier within the product improvement course of.

Ecommerce enterprise house owners promoting in america want to determine how gross sales tax works. In any other case, you’ll be on the hook for the total quantity of tax owed, along with potential fines.

There are seven main problems in US gross sales tax legal guidelines for ecommerce companies. For instance, they cost completely different charges. They exempt completely different gadgets. The dates you need to pay gross sales tax range. Typically they offer gross sales tax holidays. And these really make extra give you the results you want.

And on prime of all this, like with completely different international locations, you don’t want to gather gross sales tax in each state — even when you do enterprise there. Some states, resembling Oregon, cost no gross sales taxes in any respect. The necessities for which on-line companies gather gross sales tax are sophisticated, and all of it begins with the concept of a nexus.

Let’s begin there and undergo the seven problems.

1. Gross sales tax nexus

For many of us who’ve began companies, we by no means imagined needing to study the meanings of unusual new phrases like “nexus”. But, right here we’re. Understanding nexus is the start of determining your ecommerce gross sales tax questions.

What’s nexus?

For functions of gross sales tax, nexus means your enterprise has both a bodily or financial presence in a state and is definitely doing enterprise there. Since you are promoting merchandise in that state, the federal government believes your enterprise ought to have to gather gross sales tax.

The explanations for nexus make sense. Earlier than nexus legal guidelines got here into being, brick and mortar companies had been gathering gross sales tax, however on-line companies might ignore it. This gave on-line companies an unfair benefit, as a result of from the buyer’s perspective, they may purchase the product on-line for much less cash, even when the costs had been the identical.

So, since 2018, nexus legal guidelines have been enacted in practically each US state.

What does it imply to “do enterprise”?

It might imply a number of issues — some apparent, some shocking:

- Opening a location there

- Hiring workers or contractors who reside there, even when they work remotely

- Utilizing third get together associates situated in that state

- Storing items in a warehouse situated there

Do you promote by way of Amazon? Which Amazon warehouses are your items stored in? You’ll have a nexus in that state.

How are bodily and financial nexus completely different?

There are two sorts of nexus — bodily and financial. Bodily nexus was all that mattered, earlier than on-line companies and the web. So, the concept of gathering taxes for distant purchases solely mattered for mail-order, and most states didn’t trouble except that firm was based mostly of their state. That’s bodily nexus.

Bodily nexus means your enterprise has a bodily presence, within the type of precise areas and buildings or workers working remotely, in a state. Distant staff have sophisticated the concept of bodily nexus to some extent. In case you have six workers working in six completely different states, however your stock and bodily location is in a seventh, ought to these different states depend as bodily nexus? Every state is completely different.

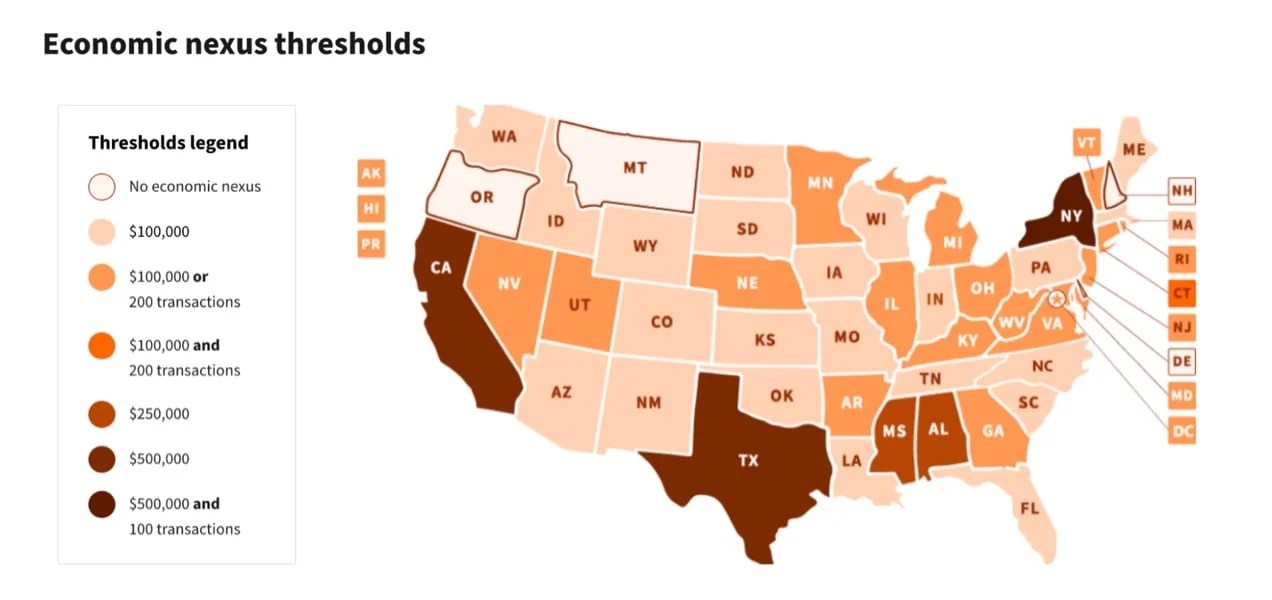

Financial nexus means you’re doing enterprise in that state, in some kind. Many states have a minimal financial nexus threshold. In case your on-line gross sales income to that state is beneath the edge, you don’t must pay gross sales tax to that state.

For instance, when you’re promoting merchandise to individuals in Texas, however your enterprise is situated in Ohio, you’ve bodily nexus in Ohio and financial nexus in Texas. In fact, when you’re in Texas and solely promote to individuals in Texas, then all of your nexus lives in Texas. 🎵 🤠 🎵

How do you discover out if in case you have a nexus in a state?

This half’s fairly simple. To seek out out, merely search for the gross sales tax legal guidelines in every state.

Right here’s a listing of each state’s financial nexus legal guidelines. Have in mind these legal guidelines can change, and it’s a good suggestion to revisit this subject about annually.

And right here’s a listing of every state’s gross sales tax nexus legal guidelines.

Preserve these assets useful so you possibly can shortly evaluation any adjustments which will occur 12 months to 12 months, and make acceptable changes in your gross sales tax assortment course of.

What ought to your enterprise do when you’ve a nexus?

First, register for a gross sales tax allow in every state the place you anticipate your enterprise to have a nexus. That method you’ll be prepared to gather and remit gross sales taxes when the time comes.

If it seems you don’t have nexus in a state, resembling if you find yourself not making sufficient gross sales in that state to satisfy the financial nexus threshold, submitting for the allow isn’t going to harm you and also you’ll be prepared for everytime you want it. Every state has its personal submitting course of.

Second, each time a buyer from that state makes a purchase order out of your on-line retailer, cost gross sales tax. Ideally, you’ll then safe these funds in reserve in order that when the time involves pay gross sales tax to every state, you possibly can simply accomplish that.

Third, take note of the dates and deadlines for when every state requires you to remit gross sales tax collections.

And fourth, every time that date arrives for every state, file gross sales tax returns. Right here’s a useful useful resource that explains how one can file gross sales taxes in each state. Don’t lose this!

2. Origin vs vacation spot

What about your private home state, the place your enterprise is situated? Bodily retailer presence or not, your enterprise is predicated someplace. And for this, there are two methods states outline themselves for functions of gathering gross sales tax from companies.

Origin-based states

Origin-based states require companies to cost the identical flat gross sales tax charge for all clients, no matter the place these clients reside.

As you possibly can most likely guess, that is the better of the 2 strategies for companies. The one complication right here comes from metropolis, county, and different native gross sales taxes. If your enterprise is situated in a metropolis, county, or district that has its personal tax charge, you’ll add that on to the state proportion.

For instance, Utah is an origin-based state — one in every of 12 such states. Utah’s present gross sales tax is 6.1%. In case your ecommerce enterprise is predicated out of Utah, you’d cost gross sales tax for all of your Utah clients at 6.1%. If your enterprise is situated in a metropolis in Utah that costs its personal 1% gross sales tax, you’ll then must cost all of your Utah clients 7.1% gross sales tax.

Once more, clients out of state are dealt with in a different way. That’s what the bodily and financial nexus threshold legal guidelines are for. However for in-state clients, that is the way you’d gather gross sales taxes when you’re in an origin-based state.

Vacation spot-based states

As you might need guessed, destination-based states decide how a lot gross sales tax to gather based mostly on the place the shopper is, not the enterprise. Once more — that is all for patrons inside your state.

Let’s use Minnesota this time. Minnesota’s tax charge is 6.875%. Let’s say your enterprise is situated in a metropolis in Minnesota with no native gross sales tax. However, you’ve clients shopping for out of your on-line retailer everywhere in the state. These cities and counties could all cost their very own gross sales taxes, and your enterprise must cost gross sales taxes at a unique charge for every buyer — based mostly on wherever they reside.

Which means county strains, metropolis borders, and particular tax districts all matter now. 39 states are at the moment destination-based states.

What if in case you have nexus in a number of states?

Some states take into account companies “distant sellers” if they’ve nexus in that state however aren’t situated there. And as a distant vendor, you could be handled as a destination-based vendor, even when the state is an origin-based state, resembling Tennessee.

In that occasion, you’ll gather taxes in line with the placement of the customer. This text from TaxJar explains about this in additional element.

What in case you are promoting to the US from outdoors of it?

In case you have US clients, however your enterprise is situated in a unique nation, does any of this matter?

Nicely, it would. If your enterprise is discovered to have nexus in any US states, then you definitely would wish to cost gross sales taxes in your clients who reside in these states.

For instance, suppose your enterprise is predicated in Kenya. In case your merchandise are saved in a warehouse in Missouri, there’s an opportunity Missouri will take into account you to have a nexus there.

That is why this text led with the query of nexus. All gross sales tax questions start there.

3. Gross sales tax holidays

This seems like a cool perk you possibly can provide your clients, proper? “No gross sales tax” is a superb advertising and marketing marketing campaign headline. And if states are providing you with a vacation from gathering and remitting gross sales tax, even higher, as a result of the advertising and marketing provide gained’t value you any cash.

Nicely, simply maintain on there a minute earlier than getting too excited.

Sure, a gross sales tax vacation sounds nice. However the particulars can get messy, actual quick. Listed here are just a few causes.

You need to replace your techniques

All of the techniques you set as much as make your gross sales tax assortment course of work should be altered. Bear in mind, you gather gross sales tax on the level of sale. In your on-line retailer, which means you must take away the gross sales tax — just for clients from the state with the tax vacation — and just for the few days it’s in impact.

Then, you must gather gross sales tax once more when the vacation ends.

This will require short-term updates to your ecommerce platform, checkout web page, post-purchase receipts, and bookkeeping software program.

There’s no consistency amongst states

With so many states having tax holidays at completely random instances, this can be one thing you find yourself hassling with steadily. So, right here’s an excellent thought — when you’re coping with gross sales tax holidays in quite a few states, which means you’re making web gross sales in all these states, too. It helps to remind your self that that is occurring as a result of your on-line retailer is doing effectively.

Solely sure gadgets are exempted — it relies on the state

Some states may give blanket gross sales tax holidays that apply to all merchandise usually topic to gross sales tax. However others solely exempt sure sorts of merchandise. You’ll must dive into all these particulars yearly and see which gross sales tax exemptions apply to your enterprise, for every state the place you’ve a nexus.

Issues are inconsistent 12 months to 12 months

Some states have gross sales tax legal guidelines in place that repair the dates for his or her tax holidays. For these, you possibly can roughly predict them 12 months to 12 months. However different tax holidays may come up on the whims of an elected official working for re-election that 12 months. There’s little consistency 12 months to 12 months for a few of these holidays, so you must keep on prime of it.

4. Altering tax charges

It’d shock you ways typically states tinker with their tax charges. It will probably occur for a complete host of causes.

State governments may resolve to simply improve the general gross sales tax charge to boost extra income. They might additionally select to decrease it, however… that’s much more uncommon.

If state gross sales taxes change, that’s the only kind of change and the simplest so that you can incorporate into your gross sales tax assortment processes. However states can change them in different methods, too.

They may change the state sale tax for explicit gadgets or industries, resembling digital merchandise. They may swap from being an origin or destination-based state. They might change the financial nexus threshold. That’s not a change in charges, however it might imply you’d have to gather and remit gross sales tax for a brand new batch of shoppers.

That is why, about annually, it’s a really good thought to put aside time to check out the gross sales tax adjustments for every state.

5. States, counties, cities, districts

It’s not simply states. Cities, counties, and particular tax districts can change their tax legal guidelines and charges at any time. They’ll alter their native tax charges. Change how they deal with gross sales taxes for sure industries. Alter the necessities for sure sorts of companies. Elevate or decrease financial nexus thresholds for distant sellers. State and native governments can change their tax legal guidelines every time they need.

In different phrases, nothing is everlasting. So you must sustain with completely different gross sales tax legal guidelines yearly to stay in gross sales tax compliance.

Now, when you occur to reside in an origin-based state, a number of the stress from native gross sales taxes could not attain you. In that occasion, except the native tax authority the place your enterprise operates adjustments your tax obligations, you’ll be capable to persist with the statewide gross sales tax charges.

6. Forms of merchandise

Sure merchandise are inclined to get picked on greater than others by state and native governments. Usually it’s ones like alcohol, firearms, or digital merchandise which will have a gross sales tax levied upon them. Typically service-based merchandise, like teaching, can fall beneath the gross sales tax umbrella. On-line education schemes that promote further assets may also be required to gather gross sales tax.

And at different instances, merchandise that had been beforehand taxed could obtain gross sales tax exemptions. Merchandise that develop into frequent targets for gross sales tax reduction embrace female hygiene merchandise and diapers.

The underside line is, if in case you have services or products which are exempt from gross sales tax, don’t assume it’s going to stay that method ceaselessly. Every state can change the foundations any time they need, and you must adapt.

7. Various remittance necessities

Some states require you to remit gross sales taxes as soon as a month. Others do it quarterly or yearly. And like something tax-related, this might change subsequent 12 months.

You may search for while you’re required to file gross sales tax returns for every state. Or, if in case you have questions, give every state’s tax assortment division a name. Right here’s a listing of telephone numbers for every state’s taxing authority.

Okay.

You made it this far, and also you’re nonetheless respiratory. Gross sales tax has develop into fairly sophisticated due to the rise in on-line gross sales. The query is, what must you do in response to what you’ve simply learn?

Right here’s the principle factor:

You wish to stay in compliance with state and native gross sales tax legal guidelines, and any relevant VAT necessities, so you possibly can develop your ecommerce enterprise and stay in good standing in all of the states and international locations you’re promoting to. So how do you handle all this? For a lot of on-line sellers, it seems like an excessive amount of. And for a lot of, it’s.

Right here are some things you are able to do to handle gross sales tax assortment:

Use gross sales tax automation software program

Most likely top-of-the-line issues you are able to do is to make use of some type of gross sales tax software program.

Tax software program does the heavy lifting for the duties that develop into very overwhelming for a lot of on-line sellers. Particularly when you’re promoting on-line in practically each state, or in a number of international locations, you may be spinning a variety of plates to maintain up on the gross sales tax necessities.

Automation software program will sustain with all of the altering necessities from each tax jurisdiction that impacts your enterprise, particularly native jurisdictions that you just typically don’t know exist.

Gross sales tax software program will:

- Monitor adjustments in gross sales tax charges

- Let you know what to do when you open up a market in a brand new tax district

- Preserve observe of tax holidays and different adjustments to gross sales tax legal guidelines

It additionally will preserve your backend techniques up to date, so your checkout web page will at all times cost gross sales tax at the correct amount for every buyer — whether or not they come from one other nation, an origin-based state, or a destination-based state.

And, tax software program will file and remit gross sales tax to every state and native tax authority, so that you don’t miss a deadline.

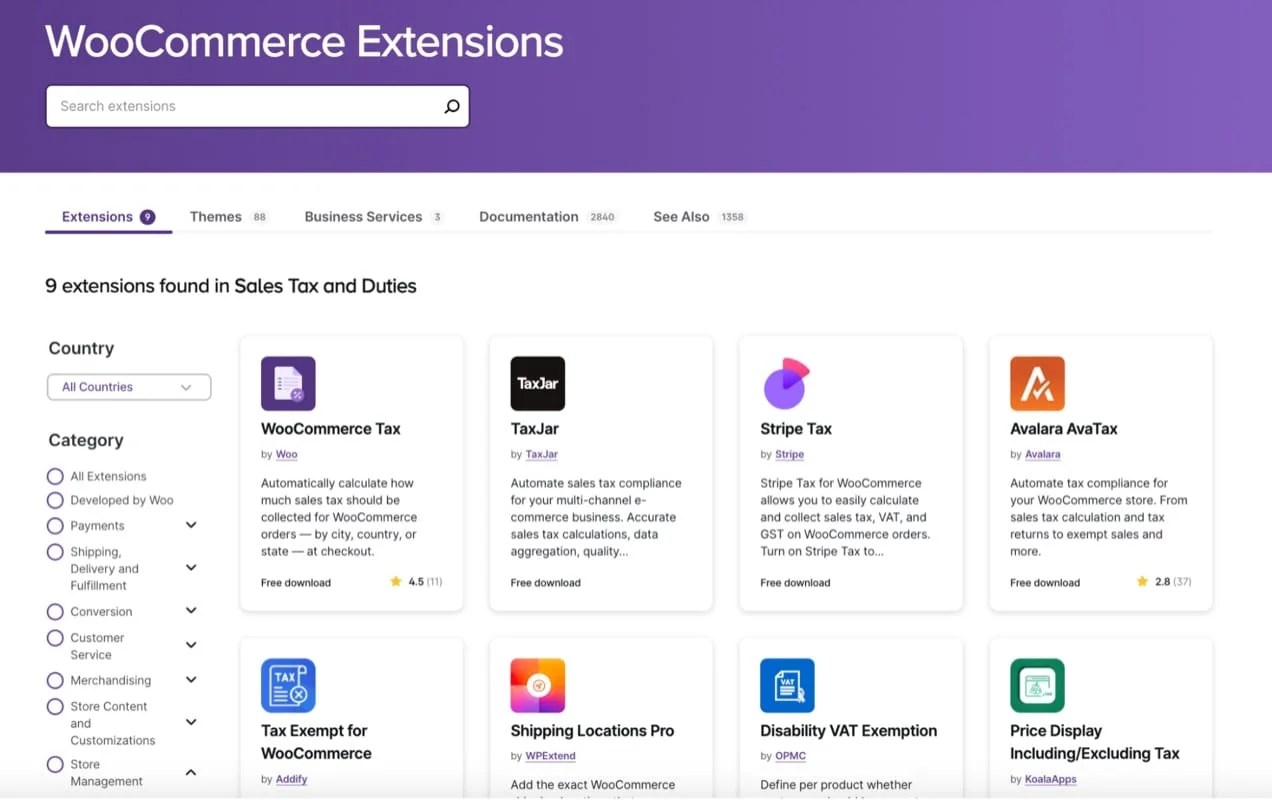

For those who construct your on-line retailer with WooCommerce, there are a selection of tax compliance extensions to select from.

Use these assets and solutions

If you’re a small enterprise proprietor, you could not really feel the necessity for tax software program simply but. Or, perhaps you’re good with bookkeeping and revel in having your hand in issues like taxes and funds, and also you wish to know what’s occurring with your enterprise.

In both of those instances, you possibly can succeed at managing your gross sales tax obligations by yourself. It’s potential. Listed here are just a few suggestions:

Keep present

For small ecommerce companies, there’s an excellent probability you aren’t promoting sufficient merchandise to most states to satisfy the financial nexus threshold. So, when you additionally don’t have a bodily presence in any state however your individual, maintaining along with your state gross sales tax necessities could not require a ton of labor when you get it arrange in your checkout web page and in your bookkeeping software program.

Right here’s what to do:

First, decide in case your state is origin-based or destination-based, and conduct your enterprise accordingly.

Then, the principle factor to remember is, your enterprise hopefully will develop. So, pay attention to which states have the bottom financial nexus thresholds. As your annual gross sales begin to rise, these could be the first states you must begin working with.

And, sustain with your individual state’s gross sales tax legal guidelines, as a result of these already apply to you, and at all times will. Know the deadlines for when to file gross sales tax in your state and any native jurisdictions.

Monitor adjustments in tax charges

For each state or nation the place you do enterprise, schedule time annually to replace your self on VAT and gross sales tax legal guidelines in these areas. For those who keep on prime of adjustments as they occur, together with financial nexus threshold adjustments and tax holidays, you possibly can replace your ecommerce platform and bookkeeping software program so all the things continues working easily.

Once more, this can take some work. However if in case you have a nostril for this form of factor, you possibly can actually handle it by yourself or with the assistance of an worker.

Prohibit your actions to keep away from pointless nexus

Now that you understand how nexus works, you possibly can beat them at their very own sport. For instance, you could possibly be certain your warehousing stays in your state. You may delay working with associates who’re out of state. You may keep away from utilizing out-of-state distributors for dropshipping.

Mainly, reduce something that may make a state authorities assume you’ve a bodily presence there. That can cut back a number of the gross sales tax challenges we’ve mentioned right here.

Think about different methods to save lots of on taxes

Along with simplifying your gross sales taxes, you can too attempt to save cash on different taxes. And please take into account, we’re not tax professionals or attorneys. See a tax accountant or different tax skilled to get agency solutions and data relating to how one can save on taxes.

Enterprise bills

Are you taking full benefit of tax deductions for enterprise bills? There are apparent deductions for issues like medical insurance plans for workers, payroll, and prices of products offered.

However you can too deduct different enterprise bills. For instance, do you are taking purchasers or distributors out for meals? You may deduct that expense. Touring to a commerce present or trade conference?

You may deduct your transportation, lodging, meals, and event-related prices.

Preserve your receipts

The important thing for issues like that is to make certain and preserve observe of your receipts. A few of these could also be bodily paper receipts. Preserve them in a separate file for enterprise bills. Different receipts can be despatched solely through electronic mail or maybe SMS. Preserve these in a digital folder.

House workplace tax deduction

In case your ecommerce enterprise operates out of your private home, there’s a tax deduction for this that relies on the sq. footage of the workplace space.

Preserve enterprise separate

Every time spending any cash on behalf of your enterprise, use enterprise debit and bank cards, and enterprise financial institution accounts. Preserve all enterprise bills separate from private ones. That makes it simple and clear for what counts as a enterprise expense.

Listed here are just a few extra tax deduction methods.

You now know all the principle points associated to staying present with gross sales taxes. You realized how tax automation software program might help gather and remit gross sales tax, and the work it’s going to take to calculate the quantity of gross sales tax to cost every buyer when you select to do it your self.

You perceive the concept of an financial nexus threshold, and the distinction between origin-based and destination-based state gross sales tax legal guidelines.

What must you do subsequent?

- Make a degree so as to add gross sales tax administration to your schedule.

- Bear in mind to maintain up with tax legislation adjustments.

- Put the dates you’re required to file and remit gross sales tax in your calendar — for every state by which you’ve a bodily nexus or meet the financial nexus threshold.

- Be sure to’re charging gross sales tax at the correct quantity for all of your clients.

And if this seems like a chore and also you wish to dramatically cut back the burden of tax compliance? Discover a tax compliance extension and ease your thoughts right this moment.