Payroll device can dramatically simplify the way you run what you are promoting. It streamlines processes, saves you precious time, and guarantees your workers receives a commission — however handiest so long as you select the correct payroll carrier to your group’s distinctive wishes.

There are dozens if no longer loads of payroll device gear made for companies like yours, so it is smart if you happen to’re no longer certain the right way to get started narrowing down your choices. Keep studying to be told extra about what to search for in payroll device, which options to prioritize, and extra.

What to search for in a payroll device

View our payroll device analysis tick list to be used for your payroll device analysis procedure. Using this listing, you’ll be able to verify off the options which can be essential for you, then you should definitely ask for the ones options all through demos with the corporate. You too can search for them when evaluating suppliers and checking out device the usage of unfastened trials.

1. Is it simple to make use of?

When I assessment a payroll device for its ease of use, my first step is to peer if the device supplier gives a unfastened trial or a unfastened account I will be able to use to check the product myself. If I will not check the product myself by means of signing up for an account at the supplier’s site, I both succeed in out to the corporate to invite for a unfastened trial, or I ask for a product demo.

As I discover the product, I in particular be aware of:

- How simple it’s to arrange the device and upload workers.

- How simple it’s to search out options that I will be able to maximum use.

- If there are strategically positioned hyperlinks or buttons that make it transparent what my choices are inside of each and every function and subsequent steps for finishing commonplace duties.

- Once I click on on a button to start a procedure throughout the device, if the device guides me on the right way to entire or arrange the method.

- If finishing commonplace duties calls for technical wisdom or if duties may also be finished by means of filling out easy paperwork.

- How simple it’s to arrange integrations with key device I plan to make use of along side the payroll device, similar to my time-tracking or accounting device.

- If there are numerous further options I will be able to by no means use that crush me.

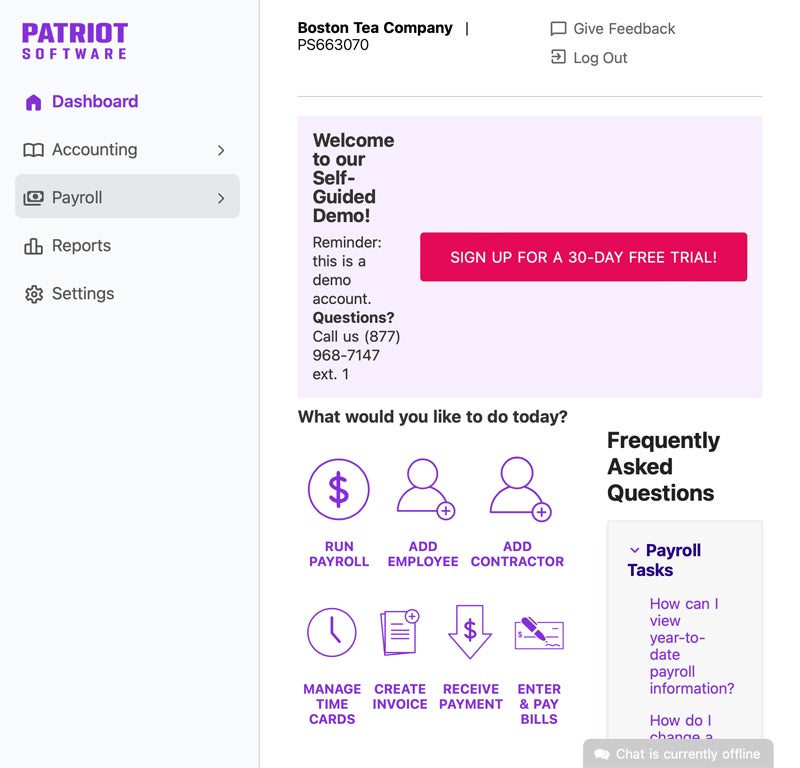

For instance, Patriot gives a guided and intuitive consumer revel in. Buttons are strategically positioned all the way through the platform with motion pieces related to the content material on each and every web page. For instance, the platform’s payroll dashboard gives buttons similar to “create invoice,” “add employee,” and “run payroll.”

Once you click on on a button, each and every motion merchandise walks you via finishing the method the usage of easy paperwork to fill out. These steps are finished briefly paperwork. Once you’re completed with a step, you’ll be able to click on “next” to transport directly to the following one.

2. What forms of staff are you able to pay?

While maximum payroll device permit customers to pay workers, many additionally permit customers to pay contractors. In addition, maximum mean you can pay U.S.-based workers, however a handful additionally mean you can pay overseas workers and contractors. As such, take a listing of the forms of staff you now make use of and your plans for running with different forms of staff one day.

If you to find that you wish to have to paintings with overseas workers or contractors, along with making sure you’ll be able to pay each 1099 and W-2 workers, verify to peer if the device you select gives employer of document (EOR) and contractor of document (COR) services and products that may mean you can rent and pay workers in overseas nations with no need to arrange enterprise entities throughout the nation. In addition, verify to peer what currencies you’ll be able to use to pay workers and the nations it helps.

If you propose to rent contractors, ensure safeguards are in position to make sure compliance with classification regulations and coverage in opposition to misclassification consequences; some of these safeguards allow you to decide whether or not a employee may also be categorized as a contractor. Deel, for instance, gives COR services and products that mean you can cross on misclassification liabilities to Deel whilst leaning on Deel mavens to advise you on the proper classification for each and every new rent.

3. How are hard work taxes treated?

When I assessment a payroll device, I pay shut consideration to the way it helps shopper companies in managing their hard work tax duties. Since many small companies don’t have on-staff tax mavens, I consider the most productive payroll device must be offering the next helps:

- Automatic hard work tax calculations and deductions.

- Automated tax fee remittance to native, federal, state, and world if acceptable government.

- Multi-state tax control give a boost to.

- Tax error detection indicators.

- Penalty coverage that covers punitive fees must the device miscalculate or pass over paying the proper quantity of taxes.

- End-of-year tax submitting gear, processes, and give a boost to.

- An worker self-serve portal the place workers can get entry to their tax paperwork routinely.

- Tax mavens to steer you in any questions you might have relating to your hard work taxes.

4. Does it be offering automatic payroll calculations?

At its most simple, payroll device exists to calculate worker paychecks routinely so that you don’t need to. Most payroll device can accommodate salaried and hourly workers, however double-check that each are integrated within the payroll carrier you select sooner than signing up.

If you will have hourly workers, ensure your payroll device both integrates with time and attendance device or gives a integrated time monitoring resolution; differently, you’ll have to go into workers’ hours labored by means of hand, which wastes time and will increase the potential for presented mistakes.

Paycheck calculation is ready greater than calculating an worker’s gross pay, or the entire reimbursement they’re entitled to in keeping with their hours labored. Payroll device additionally calculates workers’ internet pay, which accounts for paycheck deductions like the next:

- Wage garnishment, or court-ordered paycheck deductions for money owed like spousal or kid give a boost to.

- Income, Medicare, and Social Security taxes.

- Benefits deductions, similar to employee-paid premiums for medical insurance.

- Retirement contributions to 401(okay) accounts or different retirement financial savings accounts.

The very best payroll device must come with payroll tax calculations with each plan, however salary garnishment is continuously an add-on function that prices further. (Services that come with salary garnishment at no further value, similar to OnPay, are somewhat unusual.) Some payroll device, like Patriot Payroll, permits you to input advantages deductions by means of hand however doesn’t come with automated advantages management.

5. What fee choices does it be offering?

When taking a look at a device’s fee choices, I take a look at its direct deposit choices, its verify choices, whether or not it gives a pay card, what pay schedules it might probably accommodate, whether or not I will be able to run limitless pay runs each and every month, and if I will be able to pay off-schedule bills similar to bonuses. Here’s what to imagine relating to each and every of those choices:

- Direct deposit: Most payroll device be offering one- or two-day direct deposit payroll choices; some be offering same-day direct deposit choices. If you want a same-day direct deposit, verify to peer if any charges are related to making this fast possibility to be had.

- Checks: Look to peer if you’ll be able to print out exams from the payroll device or if the supplier delivers published exams to what you are promoting. Keep in thoughts that some payroll device don’t be offering a pay-by-check possibility, so if you want this feature, examine together with your supplier its availability.

- Pay schedules: Look to peer if your preferred payroll device contains the pay time table you’re used to, similar to weekly, bi-weekly, or per month. Also, imagine whether or not you’ll be able to pay off-cycle bills similar to bonuses.

- Number of payroll runs: If you propose to pay workers greater than as soon as a month, you should definitely be sure your preferred device contains a couple of payroll run monthly. Many be offering limitless payroll runs to take away this worry out of your listing.

- Pay card choices: These are fee playing cards continuously equipped by means of employers to workers who do not need a checking account and would really like an alternate mode of receiving their bills by way of direct deposit.

6. Is it scalable?

A scalable payroll device means that you can proceed the usage of it successfully at the same time as you enlarge the collection of customers. To accomplish that, it continuously comprises the power to faucet into automations to extend efficiencies as wanted and pricing plans that accommodate extra customers as wanted. It may also come with gear to mean you can outsource or quit duties to customers, similar to an EOR carrier and an worker self-serve portal. Other parts to imagine are the collection of customers the platform permits and if you’ll be able to build up your plan capability and features by means of buying upper tiered plans or add-ons.

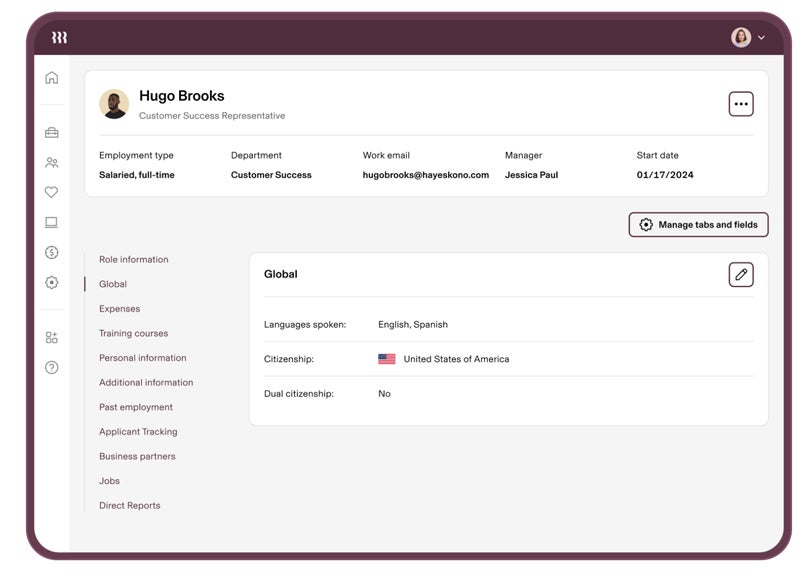

For instance, Rippling gives an worker grid (intensive worker profile) that captures key details about your workers, similar to their roles, pay charges, places, and extra. Then, when a transformation is made, for instance, to an worker’s function, all in their get entry to choices, pay charges, advantages, or even credentials are routinely modified to mirror and accommodate the wishes of the brand new function. This signifies that even while you’re dealing with a big team of workers, adjustments may also be completed right away, permitting you to successfully arrange extra.

7. What reporting and analytics does it be offering?

By offering reporting and analytics purposes, payroll device is helping corporations stay monitor in their duties and make sure they may be able to meet them. Some examples of key payroll experiences to search for come with:

- Payroll abstract file: This file means that you can filter out payroll details about an worker, division, or your whole team of workers by means of a date vary and continuously comprises an accounting of gross and internet wages, withholdings, and deductions.

- Payroll tax legal responsibility file: In this file, you’ll see what taxes had been withheld from each and every worker’s wages and what kind of used to be remitted to govt companies because of this. You’ll additionally be capable of see how a lot you continue to owe.

- Retirement contributions: This file gives the contribution quantity to retirement plans similar to 401(okay) and 403(b) plans from each the employer and worker.

- Benefits experiences: You can use this report back to discover what number of workers as opposed to employers pay premiums.

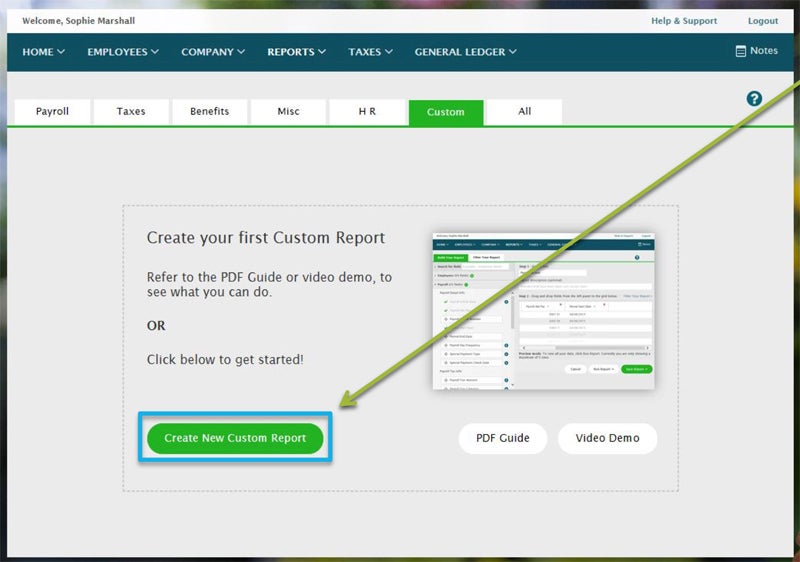

Many device, similar to ADP, be offering the power to create tradition payroll experiences that may continuously be comprised of scratch or from a template you convert to deal with your wishes. For instance, you’ll be able to select what information or fields you’d like to incorporate, which workers it’s going to duvet, and filter out choices. For instance, you could come with handiest managers inside of a selected division, a box appearing paid-time-off (PTO) accumulations and closing balances, and a date vary of handiest 30 days. Once you’ve created your tradition file, you’ll be able to continuously reserve it to proceed monitoring the desired information.

8. Does it be offering compliance give a boost to?

Companies should sparsely adhere to compliance regulations concerning worker pay at the state and federal stage; if they don’t, they is also fined. Because the legalities desirous about payroll compliance may also be technical and complicated, I search for a payroll device that automates and guides companies to adhering to those rules, at the same time as they alter. Some compliance duties a just right payroll device might lend a hand to control come with:

- Wage withholdings for kid give a boost to and different garnishments.

- Adherence to the Fair Labor Standards Act (FLSA), the Equal Pay Act (EPA), the Federal Insurance Contributions Act (FICA), and federal source of revenue taxes (FIT), the Federal Unemployment Tax Act (FUTA) (together with withholdings and remittance of related bills).

- Adherence to rules surrounding minimal salary and time beyond regulation pay necessities.

- Support for prevailing wages, continuously with state-specific prison steerage indicating the requirement to pay at minimal the typical pay for in a similar fashion hired staff.

- Certified payroll necessities for federal contract jobs.

- Support for state-specific ultimate paycheck and payday necessities.

9. Does it combine with different device?

Many payroll device suppliers be offering a method to at once combine your payroll device with different generation you utilize to run what you are promoting’s accounting and HR purposes. For instance, many be offering integrations with well-liked accounting, HRIS, and time-tracking device. This permits your payroll device to retrieve and sync worker information throughout all methods for extra correct payroll processing.

For instance, if you happen to combine your time-tracking device together with your payroll device, your payroll device positive factors fast get entry to to the hours workers labored, permitting it to routinely calculate each and every worker’s pay each and every pay cycle. In doing so, you keep away from guide enter of hours labored and any mistakes that can rise up from that human procedure.

So, take a listing of the generation you’d love to combine together with your payroll device and verify together with your payroll device supplier to make sure the ones integrations are conceivable, both by way of an immediate integration partnership between the 2 platforms or an API that permits you to create a tradition integration.

10. Can you customise the device?

Many payroll device be offering strategies you’ll be able to use to customise the platform on your wishes or emblem. These customizations may also be so simple as importing your corporate’s brand to the device’s dashboard so shoppers and workers can revel in a branded consumer interface. Or, customizations may also be extra complicated.

For instance, UKG Ready Payroll gives a customizable reporting capability. You can create a number of dashboards with handiest the payroll experiences you wish to have on them, similar to payroll fairness experiences. You too can save those dashboards to percentage together with your staff. From there, the platform will accumulate insights out of your custom-built experiences and be offering AI-powered steerage on how your staff must put them into motion to fortify what you are promoting.

An effective way to judge whether or not an organization gives the customizations your corporate wishes is to e-book a demo with a gross sales consultant and pass over your particular customization wishes. The consultant can then stroll you via whether or not the ones customization choices are to be had and the way simple or tricky it’s going to be to put in force them.

How to select payroll device for what you are promoting

1. Consider what you are promoting’s team of workers

Make an in depth listing of your corporate’s payroll device wishes. Consider the forms of staff you rent, what number of you will have, the place they paintings (in a selected state or in a foreign country), in the event that they’re seasonal, your fee time table, and the way you propose to pay workers.

2. Understand which payroll options you want

Once you’ve concept sparsely about your team of workers’s wishes, it’s time to dig into which payroll device options you’ll be able to’t reside with out. You can discover a extra detailed description of the highest payroll options in our complete payroll information.

3. Carefully calculate payroll prices

Nearly the entire very best small-business payroll device methods price each a per month base rate and a per-employee rate. Consider each for your calculations. You’ll additionally need to imagine add-on charges for services and products like accounting device integration, global payroll, worker advantages management, multistate tax carrier, and time-clock device. Consider prioritizing device with more than one plans that you’ll be able to simply scale as much as as you rent extra folks.

4. Narrow down your payroll device choices

Our article at the very best payroll device of the yr can function a jumping-off level to your analysis as you slim down your choices to the most productive payroll device to fulfill your wishes.

If studying an extended evaluate is overwhelming, right here’s our greatest-hits listing of payroll device to imagine:

- Gusto ($40 monthly plus $6 consistent with individual) is normally regarded as the highest payroll device supplier for small, midsize, and massive companies.

- Paychex ($39 monthly plus $5 consistent with individual) has extra add-on charges than maximum of its competition, however it additionally has one of the vital very best HR libraries of any blended HR and payroll product.

- OnPay ($40 monthly plus $6 consistent with individual) is without doubt one of the maximum totally featured payroll corporations with the fewest add-on charges and hidden prices.

- PositivePayroll by means of Paychex ($20 monthly plus $4 consistent with individual) is without doubt one of the least expensive payroll services and products made in particular for small-business house owners.

- ADP (tradition pricing handiest) gives a wide variety of flexible payroll merchandise that may accommodate the smallest of small companies in addition to large world enterprises.

If you’re in search of essentially the most inexpensive possibility, consult with our very best affordable payroll device and our very best unfastened payroll device guides.

5. Take benefit of demos and unfastened trials

Many payroll device suppliers be offering a unfastened trial or unfastened account setup; those who don’t will typically be offering unfastened, custom designed demos that stroll you via each side of the device. Payroll device corporations with unfastened trials come with the next:

While Gusto and Square Payroll don’t be offering unfastened trials, each choices permit consumers to arrange accounts without cost; you gained’t be charged till you make a decision to run payroll for the primary time.

6. Get knowledgeable recommendation from a payroll specialist or accountant

If you’re a brand new enterprise proprietor processing payroll for the primary time, I strongly counsel talking with an accountant and payroll specialist to higher perceive your payroll obligations, together with and particularly your payroll tax duties. An accountant too can level you towards the very best payroll device for accountants, which might affect your ultimate device choice.

7. Reevaluate as wanted

If you’ve signed up for a payroll plan, began working payroll, and located that you simply love your new payroll device, that’s very good information. Keep in thoughts, although, that it’s ok to modify suppliers in case your payroll wishes trade or in case your new device doesn’t can help you up to you was hoping it will.

No Comment! Be the first one.