The very best low cost payroll suppliers mix a fantastic value level with important options to stay compliant with state and federal legal guidelines whereas paying workers precisely and on time. Most additionally embrace complementary instruments, resembling time monitoring, a human sources data system (HRIS), and advantages administration instruments alongside an intuitive consumer interface and automation instruments to save lots of your organization money and time.

After evaluating and testing dozens of payroll software program, I narrowed down my listing of low cost payroll software program to the highest 10. To take action, I scored every supplier on worth for the cash, options, ease of use, buyer assist, and consumer opinions. Listed here are my high picks.

High low cost payroll companies comparability

| Our score (out of 5) | Beginning value | Automated payroll | Pay workers and contractors | HR instruments | |

|---|---|---|---|---|---|

| Gusto | 4.6 | $40 monthly, plus $6 per consumer monthly | Sure | Sure, as an add-on | Sure |

| Workful | 4.5 | $45 monthly, plus $7 per individual monthly | Sure | Sure | Sure |

| Justworks | 4.5 | $50 monthly, plus $5 per individual monthly | Sure | Sure | Sure |

| Homebase | 4.2 | $39 monthly, plus $6 per individual monthly | Sure | Sure | Sure |

| Deel | 4.1 | $19 monthly per individual monthly | Sure | Sure | Sure |

| Patriot Payroll | 4.1 | $17 monthly, plus $4 per individual monthly | No | Sure | Sure |

| OnPay | 4.1 | $40 monthly, plus $6 per individual monthly | No | Sure | Sure |

| RUN Powered by ADP | 4.0 | Quote required | Sure | Sure | Sure |

| QuickBooks Payroll | 3.9 | $85 monthly, plus $6 per individual monthly | Sure | Sure | Restricted |

| Sq. Payroll | 3.7 | $35 monthly, plus $6 per individual monthly | Sure | Sure | Sure, however largely through add-on plans |

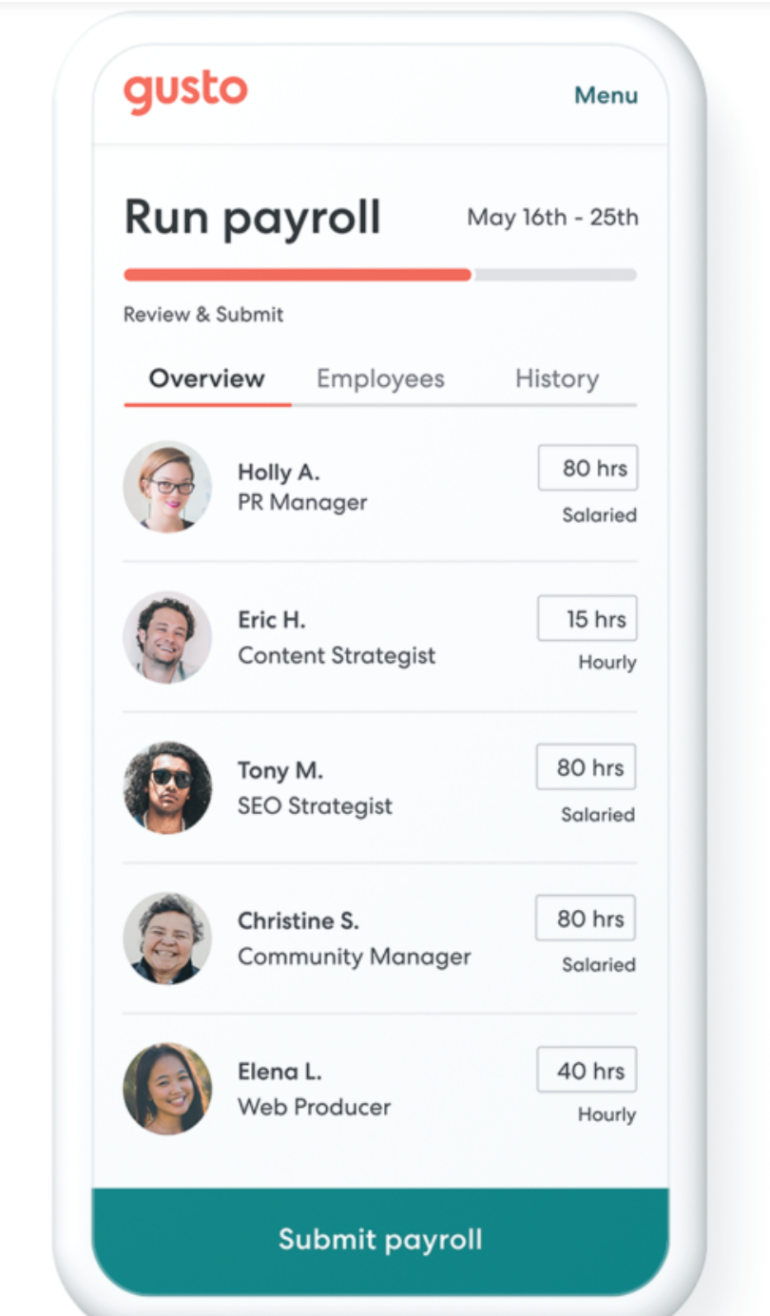

Gusto: Greatest general

Our score: 4.6 out of 5

Gusto doesn’t simply supply payroll instruments however advantages and HR instruments as nicely—multi function platform. Its plans begin at an reasonably priced $40 monthly, plus $6 per worker monthly. In its first-tier plan, you get pleasure from full-service single-state payroll companies. It’s also possible to add states by upgrading to Gusto’s Plus plan. General, Gusto is a good possibility for small companies on the lookout for an all-in-one platform to handle HR and payroll-related processes at the same time as your organization grows.

Pricing

Gusto provides 4 plans. Right here’s a short overview of every:

- Easy: Beginning at $40 monthly, plus $6 per worker monthly, you get fundamental payroll instruments. It consists of full-service payroll companies for a single state, fundamental hiring and onboarding instruments, reporting, worker profiles, and an worker self-service portal.

- Plus: This plan is often $80 monthly, plus $12 per individual monthly, although it usually runs promotional pricing. It provides multi-state payroll to the Easy plan options, along with time-tracking, expense administration, worker efficiency, and workforce costing instruments.

- Premium: Beginning at $180 monthly, plus $16.50 per worker monthly (with promotional pricing often accessible), this plan provides devoted assist and HR administration instruments to the Plus options.

- Contractor Solely: This plan means that you can pay contractors and use it together with your payroll plan. It’s $35 monthly, plus $6 per worker monthly for limitless contractor funds throughout all 50 U.S. states.

Gusto professionals and cons

| Execs | Cons |

|---|---|

|

|

Why I selected Gusto

Gusto is a one-stop store for all the pieces it’s worthwhile to run payroll. It even consists of time-tracking instruments that robotically sync with payroll for correct pay runs and HR instruments to maintain you compliant with labor legal guidelines. It additionally means that you can broaden to different states by tapping into its Plus or Contractor Solely plans. Each of those plans can help you pay employees in all 50 U.S. states to accommodate firm development. Lastly, its devoted buyer success supervisor companies in its top-tier plan assist to assist corporations as they broaden into new territories.

Be taught extra about Gusto

Workful: Greatest for ease of use

Our score: 4.5 out of 5

Workful is a good alternative in case you are on the lookout for a simple platform to deal with your whole HR, time monitoring, payroll, worker bills, and reporting wants with one month-to-month value. Since all these instruments can be found and sync robotically, you don’t must combine exterior platforms. Along with automated syncing and calculations, additionally lending to its ease of use, you too can run payroll from begin to end in 4 clicks from any system.

Pricing

Workful provides one all-inclusive plan for $45 monthly, plus $7 per staff member monthly. This plan consists of all of Workful’s payroll, time monitoring, worker self-service, and HR administration instruments.

Workful professionals and cons

| Execs | Cons |

|---|---|

|

|

Why I selected Workful

I selected Workful as a result of it provides numerous instruments to make working payroll simple, resembling time monitoring. Workers should solely clock out and in of their shifts and their time is robotically calculated, together with additional time, and synced to payroll. This implies no handbook time entrances or complicated calculations come payday. It additionally provides different automated instruments that sync with payroll, resembling expense monitoring. And, its worker portal permits workers to handle many HR duties with out your involvement, resembling accessing pay stubs and tax kinds, requesting day without work, and extra.

Justworks: Greatest for strong buyer assist

Our score: 4.5 out of 5

Along with providing payroll instruments, Justworks provides HR software program and entry to worker advantages. It stands out by offering strong human assist for small companies, even these seeking to broaden with a worldwide workforce. Its Skilled Employer Group (PEO) and Employer of Document (EOR) companies give companies entry to licensed professionals and even entire groups for outsourced hiring and payroll.

Pricing

Justworks provides three paid plans, together with its Payroll, PEO Primary, and PEO Plus plans. Here’s a temporary overview of every:

- Payroll: This plan is $50 monthly, plus $8 per worker monthly. It supplies fundamental options, resembling payroll for all workers throughout a number of states, a number of pay charges, and contractor funds.

- PEO Primary: This plan is $59 per worker monthly and provides compliance, assist, and HR instruments.

- PEO Plus: At $109 per worker monthly, this plan provides HR and advantages options to the PEO Primary plan.

Justworks professionals and cons

| Execs | Cons |

|---|---|

|

|

Why I selected Justworks

I selected Justworks as a result of it provides small companies ample assist for scaling their operations and selling development. Its PEO plans supply 24/7 buyer assist through Slack, electronic mail, cellphone, and chat. In these plans, you possibly can entry licensed HR consultants, harassment prevention and inclusion coaching, an HR useful resource middle, compliance assist, and advantages administration assist. And, should you plan to rent overseas, you possibly can even rent Justworks to deal with all hiring and payroll processing for you through its EOR companies. That is particularly useful should you’re dealing with a startup and want extra hand-holding along with your first payroll or in case your payroll is just too complicated that you simply want professionals to advise on finest practices.

Be taught extra about Justworks

Be taught extra about Homebase

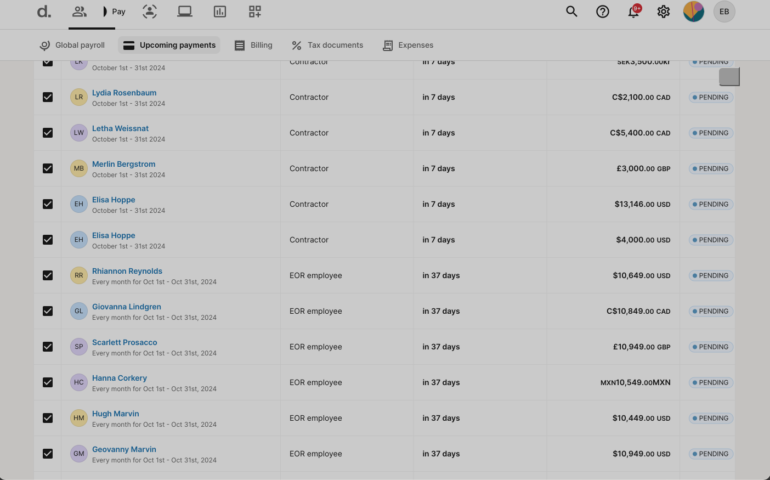

Deel: Greatest for outsourcing payroll

Our score: 4.1 out of 5

Deel is a World Folks platform that gives all of the instruments it’s worthwhile to handle and pay a worldwide workforce. It consists of onboarding, hiring, tax administration, bill administration, HR software program, and payroll software program. Notably, corporations can outsource their international payroll must Deel to keep away from having to arrange entities in international nations when hiring overseas.

Pricing

Deel provides two payroll plans, one for U.S.-based and one for international payroll processing.

- Deel US Payroll: This plan is $19 per worker monthly. It provides instantaneous calculations, registration assist in all 50 U.S. states, automated tax submitting and cost remittance, new rent filings, and 24/7 compliance and payroll assist.

- Deel Payroll: Beginning at $29 per worker monthly, this plan means that you can pay workers globally via your personal internationally-based entities.

Along with providing payroll software program choices, Deel provides EOR companies beginning at $499 monthly. It means that you can outsource hiring and paying workers throughout the globe with out having to arrange a enterprise entity in every nation.

Deel: professionals and cons

| Execs | Cons |

|---|---|

|

|

Why I selected Deel

I selected Deel as a result of it provides companies that enable small companies to outsource payroll processes which may be too complicated for inner administration. It will possibly additionally save corporations cash and complications in the event that they want to rent worldwide workers.

For instance, you possibly can course of hiring and payroll totally via Deel. This protects your organization from having to arrange an entity in every nation for international hiring and payroll functions. It additionally comes with native authorized specialists in over 200 nations, supplying you with peace of thoughts that your organization will stay compliant when hiring and processing payroll overseas.

Be taught extra about Deel

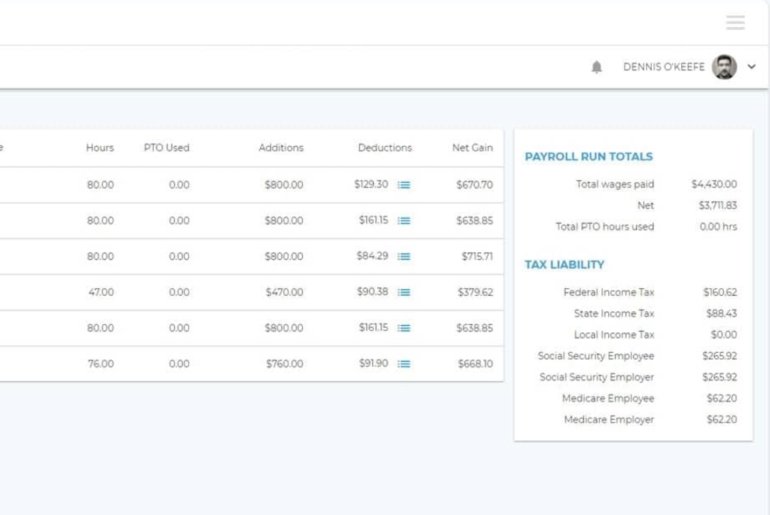

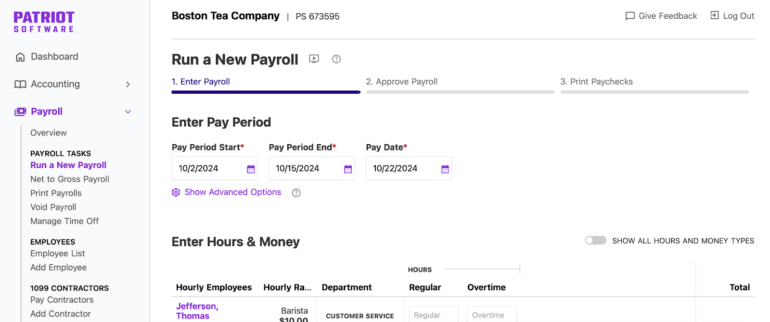

Patriot Payroll: Greatest for paying contractors

Our score: 4.1 out of 5

Patriot provides a simple payroll processing software program that begins at a really reasonably priced $17 monthly, plus $4 per consumer monthly. This comes with strong payroll processing instruments for workers and contractors, federal and state tax filings; year-end payroll tax filings; and a tax submitting accuracy assure. Plus, you possibly can add on Patriot’s time and attendance and HR software program instruments.

Pricing

Patriot Payroll provides two plans:

- Primary Payroll: Begins at $17 monthly, plus $4 per contractor or worker for its fundamental payroll software program plan. It consists of strong payroll processing instruments.

- Full Service Payroll: Patriot’s Full Providers payroll plan is $37 monthly, plus $4 per contractor monthly. It supplies all Primary Payroll plan instruments, plus tax administration and submitting instruments and companies.

Patriot Payroll professionals and cons

| Execs | Cons |

|---|---|

|

|

Why I selected Patriot Payroll

Patriot Payroll is a good possibility for corporations on the lookout for strong payroll processing instruments for beneath $20 monthly. It is usually a platform you possibly can develop into because it provides add-ons to your plan, together with instruments to deal with payroll taxes, worker time and attendance, and HR wants. It additionally comes with strong accounting instruments for corporations that have to course of invoices, settle for bank card funds, and pay distributors, resembling manufacturing corporations.

Be taught extra about Patriot Payroll

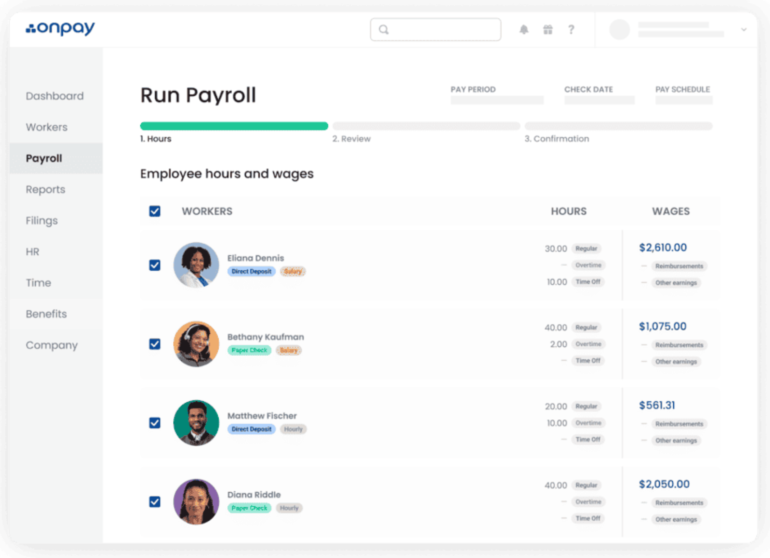

Onpay: Greatest for multi-state payroll

Our score: 4.1 out of 5

Along with payroll software program, OnPay provides HR and advantages administration instruments. It stands out by offering strong payroll options for U.S.-based companies, even providing limitless pay runs in all 50 U.S. states in each plan.

Pricing

OnPay provides one all-inclusive plan for $40 monthly, plus $6 per worker monthly. The plan consists of:

- Limitless pay runs and schedules

- Federal, state, and native tax filings

- The power to pay employees in all 50 U.S. states

- Telephone, chat, and electronic mail assist

- A small choice of integration choices, resembling time-tracking instruments

- The power to pay contractors

- Direct deposit

- Business-specific options

- HR instruments

- Advantages administration instruments.

Onpay professionals and cons

| Execs | Cons |

|---|---|

|

|

Why I selected OnPay

I selected OnPay as a result of it uniquely provides reasonably priced and strong payroll options for multi-regional U.S.-based corporations. Such options embrace limitless pay runs and pay schedules, the power to pay employees in as many states as you want at no additional price, and automatic tax filings on the native, state, and federal degree. Whereas some suppliers request extra charges for multi-state payroll, OnPay’s single plan is all-inclusive at simply $40 monthly, plus $6 per worker monthly.

Be taught extra about OnPay

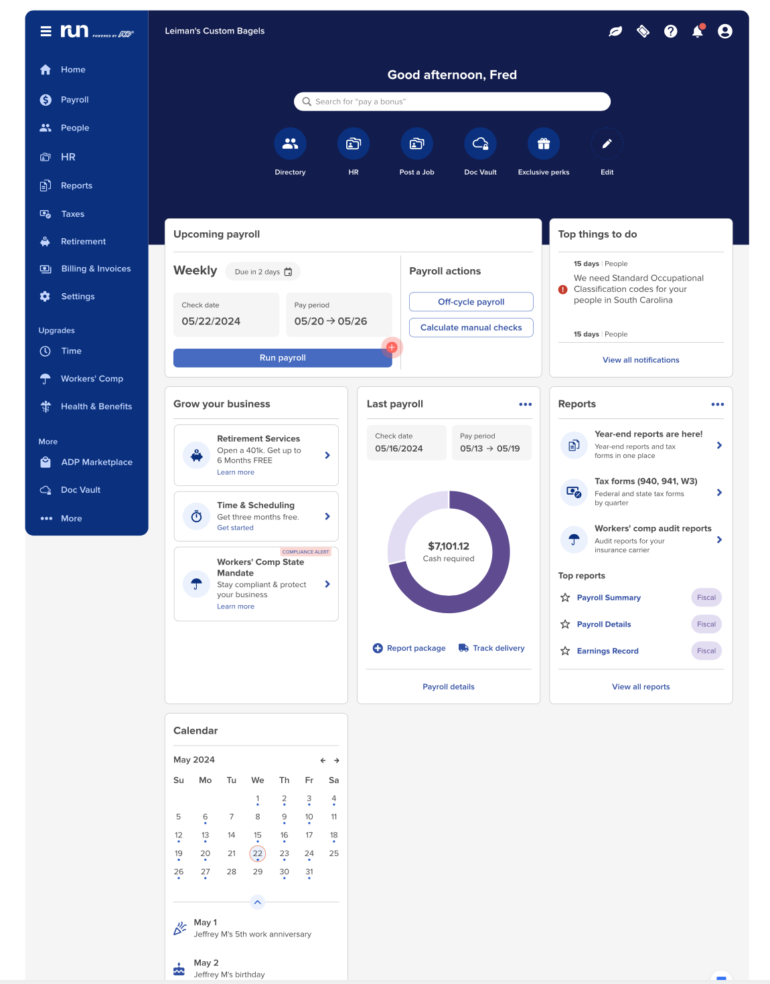

RUN Powered by ADP: Greatest for rising mid-sized companies

Our score: 4.0 out of 5

RUN Powered by ADP provides all of the instruments it’s worthwhile to develop. For instance, it has 4 plans that vary from fundamental payroll to superior HR and payroll instruments. It additionally comes with alerts that will help you guarantee you might be all the time in compliance. These assist you handle the more and more complicated wants of a rising enterprise. Even its most elementary plan provides multi-jurisdiction and multi-company administration to assist your small business develop.

Pricing

RUN has 4 plans, which embrace payroll-related instruments and different add-on complementary HR instruments. Here’s a rundown of every:

- Important Payroll: This plan provides fundamental payroll, tax administration, and compliance instruments. Even with this fundamental plan, you possibly can handle a number of firm entities.

- Enhanced Payroll: The Enhanced Payroll plan provides all of the instruments inside the Necessities Payroll plan, plus state unemployment insurance coverage (SUI) administration instruments, job costing, and a function that allows you to put up job postings on ZipRecruiter.

- Full Payroll and HR Plus: Right here, you get all of the options of the primary two tiers, plus HR instruments that will help you arrange your HR division and insurance policies. It additionally consists of an HR HelpDesk, an worker handbook wizard, wage benchmarks, HR monitoring, HR kinds and paperwork, and HR coaching and toolkits.

- HR Professional Payroll and HR: This plan provides probably the most superior payroll and HR instruments, together with all the pieces within the earlier plans. It additional provides an Applicant Monitoring System (ATS), a studying administration system, sexual harassment and prevention coaching, and authorized help.

To be taught pricing on every plan, you need to request a customized quote accessible via the RUN pricing web page.

RUN Powered by ADP professionals and cons

| Execs | Cons |

|---|---|

|

|

Why I selected RUN Powered by ADP

I primarily selected RUN for its development instruments. It has 4 plans and you can begin with an Necessities Payroll with strict payroll, tax administration, and compliance instruments. Even with simply this plan, you already get instruments to handle multi-jurisdictional and multi-company payrolls. From there, you possibly can improve as it’s worthwhile to an enhanced payroll plan all the way in which as much as an enhanced HR and payroll plan. Its higher-tiered plans embrace authorized help and a proactive HR assist staff that will help you navigate firm development and its beforehand unchartered territories.

Notably, RUN additionally provides AI-assisted error flagging to make sure you aren’t making errors as your organization’s wants turn out to be extra complicated. Additional, its automation assist you scale so you possibly can concentrate on the duties that actually want your consideration. For instance, the platform handles your whole federal, state, and native payroll taxes and you may set recurring payroll on autopilot. Lastly, it robotically updates to stick to federal and state tax legal guidelines and HR laws in all states the place you do enterprise, so your automations are all the time in compliance.

Be taught extra about RUN Powered by ADP

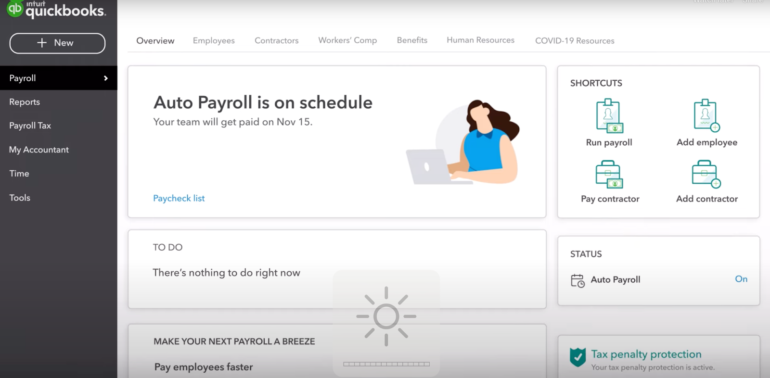

QuickBooks Payroll: Greatest for 10 workers or fewer

Our score: 3.9 out of 5

Traditionally, QuickBooks was primarily an accounting and bookkeeping device. Nonetheless, it has added bundled payroll plans that embrace its extra conventional bookkeeping options along with well being advantages, and a few accounting options. General, it’s best for small corporations with both salaried or hourly employees throughout the board.

Pricing

QuickBooks Payroll provides three bundled payroll and accounting device plans that vary from $85 to $184 monthly. It additional provides strictly payroll plans that begin at $50 monthly and vary as much as $130 monthly. Right here is an outline of every:

- Payroll Core + Easy Begin: For $85 monthly, plus $6 per individual monthly, you get fundamental accounting instruments with auto payroll and next-day direct deposit capabilities.

- Payroll Core + Necessities: At $115 monthly, plus $6 per individual monthly, this plan provides you instruments to pay your staff, observe billable hours, and pay your organization payments.

- Payroll Premium + Plus: At $184 monthly, plus $9 per worker monthly, this plan provides you all of the instruments of the earlier tiers, plus options to trace tasks and merchandise, and handle your organization’s HR and advantages administration wants.

- Payroll Core: For $50 monthly, plus $6 per worker monthly, you get entry to instruments for managing your payroll taxes and paying your workers robotically.

- Payroll Premium: This plan is $85 monthly, plus $9 per worker monthly and it means that you can observe worker time and entry QuickBooks Payroll’s HR assist middle, along with paying your workers.

- Payroll Elite: Beginning at $130 monthly, plus $11 per individual monthly, you get all of the instruments within the Payroll Premium plan plus a private HR advisor, skilled setup, and tax penalty safety.

QuickBooks Payroll professionals and cons

| Execs | Cons |

|---|---|

|

|

Why I selected QuickBooks Payroll

I selected QuickBooks Payroll as a result of it provides a fantastic combination of instruments for very small corporations needing to mix their accounting and bookkeeping actions with payroll to repeatedly keep apprised of their corporations’ monetary standing. As well as, it’s a nice possibility for micro companies that already use QuickBooks merchandise, resembling its accounting instruments.

I particularly referred to as it out as a device for very small corporations as a result of it solely provides the power to pay salaried employees or hourly employees. Most mid-sized companies have a combination of each salaried and hourly employees however many startups solely have one or the opposite.

Be taught extra about QuickBooks Payroll

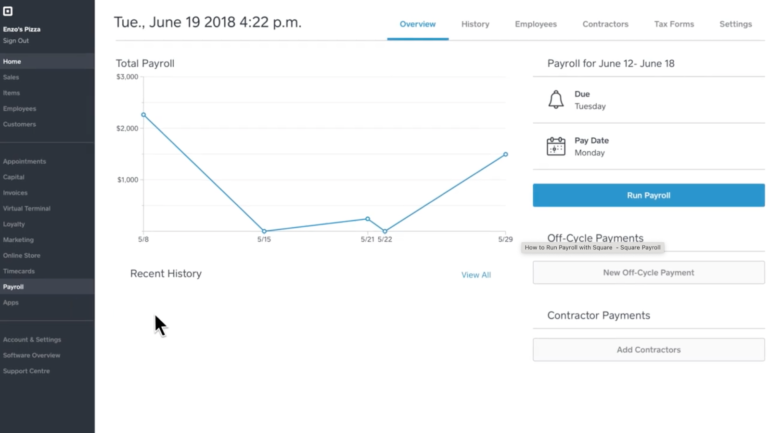

Sq. Payroll: Greatest for restaurant and retail companies

Our score: 3.7 out of 5

Sq. Payroll means that you can automate payroll for each workers and contractors. As a result of it additionally means that you can join your in-store point-of-sale (POS) system and sync your worker timecard knowledge, it’s a nice possibility for eating places or retail shops.

Pricing

Sq. Payroll begins at $35 monthly, plus $6 per worker or contractor. Seasonal corporations that aren’t paying workers often additionally don’t must pay the month-to-month value. Its payroll plan provides all key options, together with:

- Limitless pay runs monthly

- Examine, direct deposit, or Money App funds

- Auto payroll

- Off-cycle funds

- Multistate payroll

- A number of pay charges

- A Sq. staff app

- Worker self-onboarding

- Time monitoring instruments

- Scheduling instruments

- Automated administration instruments

- Compliance alerts

Sq. Payroll professionals and cons

| Execs | Cons |

|---|---|

|

|

Why I selected Sq. Payroll

I selected Sq. Payroll as a result of it uniquely provides instruments to assist small brick-and-mortar companies, like eating places and retail companies, handle their payroll. For instance, it helps you handle suggestions and worker time playing cards because it robotically syncs to payroll for accuracy and compliance. It additionally means that you can join your Sq. Payroll software program to your Sq. POS merchandise to handle payroll out of your POS dashboard simply.

Be taught extra about Sq. Payroll

Honorable Point out: SurePayroll by Paychex

General rating: 3.29/5 stars

Greatest for: Family employees payroll

Various for: Patriot Payroll

When to Select SurePayroll

For households that rent workers resembling tutors, nannies, or elderly-care employees, SurePayroll by Paychex is the very best and most reasonably priced payroll possibility accessible. For instance, its family plan is generally $59 monthly that you should use to rent one worker. Its instruments can help you simply withhold state, federal, and FICA taxes, along with paying one family worker. And, you possibly can add extra workers for $10 per worker monthly.

Why it didn’t make the listing

Whereas SurePayroll is nice for particular use circumstances, it lacks many options I search for in low cost payroll companies. For instance, it doesn’t supply entry to many complementary options small companies usually want together with payroll instruments, resembling advantages administrations. Plus, most of the options it provides are restricted in comparison with some opponents. For instance, it solely provides 24/7 assist through assist articles and chats, not via cellphone assist. You additionally should pay extra for options resembling time-tracking software program and instruments and to rent workers in multiple state.

Low-cost Payroll Software program FAQs

What’s the least expensive payroll service for small companies?

Of the respected payroll software program available on the market, Patriot Payroll is without doubt one of the least expensive. With plans beginning at $17 monthly, plus $4 per individual monthly, it provides all of the instruments it’s worthwhile to handle payroll for a single-state enterprise, together with limitless payroll runs monthly, the power to pay workers and contractors, payroll reporting, and direct deposit. Nonetheless, for a device that additionally manages your payroll taxes, you’d must improve to its dearer plan.

What’s the common price of payroll software program?

The common price of payroll software program begins with a base value of between $35 and $45 monthly, plus a per-person charge of $4 to $9 per worker or contractor paid monthly. Nonetheless, costs can vary dramatically relying on the corporate and options provided. For instance, a software program that additionally manages your payroll tax filings might be double the value of 1 that doesn’t. And, some corporations supply plans with a no-frill function set for as little as $17 monthly.

Is QuickBooks Payroll free?

No, QuickBooks Payroll isn’t free. Its plans begin at $50 monthly and vary as much as $184 monthly, relying on the options included. Nonetheless, it usually provides promotional pricing of as much as 50% off for quite a lot of months.

Methodology

I reviewed and examined dozens of payroll software program to land on the highest 10 for this listing. To take action, I evaluated every on pricing, options, buyer assist, consumer opinions, and ease of use. I additionally examined every supplier to make sure a constructive consumer expertise. From there, I compiled a rubric rating primarily based on dozens of things. I then ranked them based on the place they landed on the listing primarily based on my analysis course of.

No Comment! Be the first one.