Key takeaways

|

Everyone loves a payday, however how do you make a decision how regularly they must occur for your small business? Is it higher to pay extra steadily, making paychecks smaller in worth for my part? Or is it value it to run payroll much less steadily, thereby minimizing the collection of occasions it needs to be processed in a yr?

These are essential questions, and ones with out common solutions. So, let’s dive into what to imagine when atmosphere payroll schedules, the varieties of payroll schedules at your disposal, which schedules fit your state of affairs, and the way to make a choice and enforce one to reinforce your small business wishes.

What is a payroll agenda?

A payroll agenda is a routine monetary agenda for companies, on the finish of which, paychecks are calculated and issued for group who labored for the corporate. This might occur month-to-month, weekly, or someday in between.

To be extra particular, payroll is for inner, on-staff workers (e.g., W-2 workers within the U.S.); this doesn’t most often come with contractors and freelancers. These exterior participants most often bill the corporate as a dealer or industry spouse would, and issuing cost to them might or won’t occur on a collection agenda. Even when a contract cost agenda is in position, it’s normally fully become independent from the payroll agenda.

In the previous, companies would write or print bodily assessments for staff to money (therefore the time period “paycheck”). These days, payroll is maximum regularly treated electronically, with payroll instrument or any other answer issuing direct deposits on the finish of each and every pay length.

Types of payroll schedules

There are essentially 4 varieties of payroll schedules:

- Monthly.

- Semimonthly.

- Biweekly.

- Weekly.

Monthly agenda

Monthly payroll occurs as soon as each and every month.

Payroll date

Monthly paychecks occur at the similar date each and every month, most often the start, the mid-point, or the month’s finish.

Total once a year pay sessions

Monthly payroll runs 12 occasions over the process a calendar or fiscal yr. This agenda favors salaried workers, the ones with massive commissions and routine bonuses, or even freelancers in some instances.

Pros

- Fewer transactions imply fewer payroll sessions and less payroll calculations, in all probability resulting in decrease payroll bills.

- Team contributors by no means wish to wager when the following paycheck will roll out, because it’s the similar day each and every month.

- Additional calculations, reminiscent of commissions and advantages deductions, are more straightforward to make as a result of they don’t should be unfold over a couple of pay sessions. There are accounting advantages to month-to-month payroll, reminiscent of monitoring hard work prices through month extra simply.

Cons

- This agenda is the only maximum steadily prohibited through regulations and laws, which regularly mandate extra common bills to group.

- No one likes looking ahead to their paycheck, and relying on when a brand new workforce member begins, month-to-month payroll might go away them looking ahead to a month or longer for his or her first take a look at.

- For group who’re extra financially delicate to adjustments or mistakes, a minor glitch, error, or overlooked cost may just spell crisis if they have got to attend every other month for a repair.

Semimonthly agenda

Semimonthly is a quite common agenda, consisting of 2 bills monthly, kind of 15 days aside. This agenda advantages salaried workers, particularly when the corporate provides an important quantity of noncompensatory advantages.

Payroll date

The routine pair of pay dates range through group, but it surely’s normally one of the vital following:

- 1st and fifteenth.

- fifth and twentieth.

- tenth and twenty fifth.

- fifteenth and thirtieth.

Total once a year pay sessions

With each and every month damaged into two pay sessions, corporations run payroll 24 occasions through yr’s finish.

Pros

- Shorter pay sessions imply new hires see their first assessments in as few as two weeks.

- Deductions, fee and bonus pay, and different calculations are simple to make, as any month-to-month worth is just unfold over two pay sessions.

Cons

- Monthly dates don’t trade, however the day of the week for payroll does, making payroll a bit of exhausting to expect each for staff and finance groups.

- Not all months have the similar collection of days, and a few payroll dates fall on weekends or financial institution vacations, leading to some minor inconsistencies on paycheck quantities and pay dates, relying on corporate coverage.

- Hourly workers regularly have their paintings weeks cut up throughout a couple of pay sessions, particularly when payroll runs in the midst of the week, complicating cost calculations reminiscent of time beyond regulation pay.

Biweekly agenda

This payroll agenda runs each and every two weeks, regardless of months or different calendar divisions. It provides higher advantages for groups with essentially hourly group who might wish to calculate time beyond regulation continuously.

Payroll date

This payroll agenda is normally run so assessments will also be issued and pay deposited on the finish of a pay week. This implies that maximum biweekly payroll runs are each and every different Friday.

Total once a year pay sessions

Since this payroll agenda is damaged up into 14-day increments moderately than much less constant month-to-month cycles, it ends up in 26 pay sessions.

Pros

- Overtime, vacation paintings pay, and different pay concerns that issue closely into hourly workers’ repayment are more straightforward to trace and calculate the use of a biweekly approach.

- Facilitates striking all group on an similar pay agenda, minimizing accounting hard work for various classes and pay scales of group.

- Benefits employees with fluctuating or intermittent schedules.

- Employees obtain a “bonus” paycheck two months of each and every yr.

Cons

- Benefit calculations are extra complicated, particularly for months with 3 pay dates.

- Having to run payroll 3 times in a month is usually a tough industry expense to justify.

- Pay sessions that extend into the following month make calculating taxes, charges, and month-specific main points tough.

Weekly agenda

Weekly pay schedules run each and every seven days. As probably the most quick type of not unusual routine cost, this method is maximum recommended for companies and industries the place paintings shifts are variable, hard work is seasonal, or paintings hours differ dramatically.

Payroll date

Pay sessions for weekly schedules normally get started on Saturday, Sunday, or Monday, with the week’s finish normally taking place on Friday. In different phrases, after your first week at a task, with weekly payroll, each and every Friday is payday.

Total once a year pay sessions

Since assessments are minimize each and every week, there are 52 assessments issued to group from January 1st to December thirty first.

Pros

- Shift employees, hospitality group, part-time crews, or even freelancers all favor weekly cost moderately than having to attend a number of weeks for repayment.

- As probably the most common agenda, weekly payroll minimizes the price, and thus the expense, of each and every payroll run.

- Any inconsistencies, mistakes, or anomalies in hours, calculations, or in a different way are just one week clear of the right adjustment with the following take a look at.

Cons

- Calculating payroll is a task unto itself, and the extra steadily it occurs, the extra hard work is needed over the yr.

- If the collection of transactions is a think about the price of the use of virtual products and services to run payroll, this pay frequency maximizes that price through operating the easiest quantity and frequency of bills.

- While weekly paychecks become profitable drift extra predictable and stable for group, it doesn’t essentially do the similar for the industry (i.e., if there’s ebb and drift to the industry’s source of revenue, weekly paychecks is also tough to hide right through a drought).

Which pay agenda must you employ?

This is a difficult query to reply to except you’re in the hunt for details about particular industries or products and services; on the other hand, there are two normal laws:

- The much less solid or predictable your small business’s money drift, the extra it advantages from longer pay sessions.

- The much less constant the paintings agenda or paycheck worth, the extra recommended shorter pay sessions are to your group.

How to make a choice a payroll agenda

To select a payroll agenda, first imagine your small business wishes, together with your money drift and HR boundaries. Then, assess your workers’ wishes, world and state hard work regulations, and any boundaries related to the payroll gear you employ. Here’s a have a look at each and every of those steps and the way to entire them.

1. Consider your small business wishes

When deciding a payroll agenda, imagine the next industry wishes, together with your corporate’s money drift schedules and hard work boundaries.

Cash drift

Some companies have extra leeway than others relating to protecting payroll prices. For instance, a big store most likely has finances flowing in day-to-day, making it more straightforward to make a choice a bi-weekly pay length. Some different companies, like startups, could have to paintings all the month to collect sufficient inflowing money to hide payroll prices.

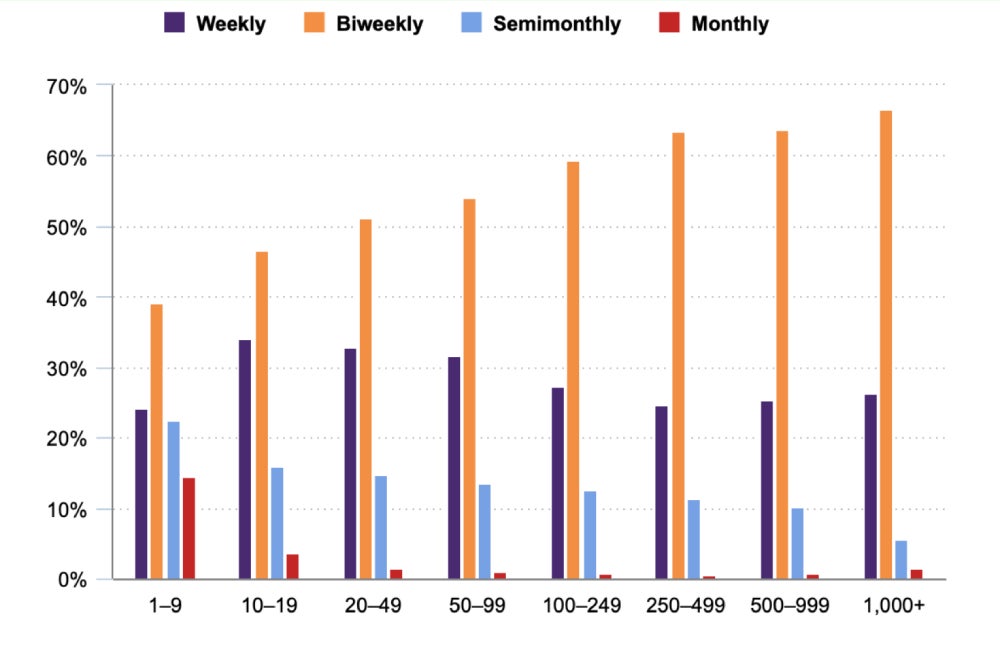

To illustrate this fact, imagine those 2023 pay frequency statistics from the U.S. Bureau of Labor Statistics:

- Companies with greater than 50 workers are much more likely to pay workers bi-weekly.

- Companies with greater than 20 workers are exponentially much less prone to pay month-to-month.

HR boundaries

Your HR division will have to juggle many tasks, reminiscent of atmosphere and upholding habits insurance policies during your company, recruiting and onboarding new hires, managing worker conflicts, and making sure worker efficiency evaluations are scheduled and finished on time. Running payroll a number of occasions a month will not be possible inside their time constraints.

On the opposite hand, if they have got get entry to to payroll automation gear, operating payroll a couple of occasions a month won’t require extra hard work or time invested. Or, possibly you lean on a qualified employer group (PE) like ADP TotalSource to run your payroll, thereby easing your inner HR group’s tasks, although you enforce extra common pay runs each and every month.

So, when opting for a payroll agenda, imagine your HR group’s present tasks, their bandwidth to satisfy the ones expectancies, and the gear they may be able to make use of to ease their workloads.

2. Consider your workers’ wishes

Now that you understand what pay schedules are attainable to your HR division, it’s time to check a kind of pay schedules for your worker personal tastes as carefully as is possible. Considering your workers’ personal tastes when opting for a payroll agenda permit you to each retain and draw in most sensible ability. When taking into consideration your workers’ wishes, in moderation steadiness their personal tastes towards your corporate’s bandwidth to run payroll.

To discover worker personal tastes, imagine the varieties of workers you use. For instance, hourly workers and shift workers regularly have variable paychecks each and every payday and smaller paychecks than their salaried opposite numbers; as such, they’ll favor a weekly or bi-weekly pay agenda to make sure smaller pay gaps when dwelling paycheck to paycheck. On the opposite, salaried workers might favor a month-to-month agenda or person who runs each and every 15 days so they may be able to expect their pay quantities each and every pay length.

Another issue to imagine is marketplace expectancies. Some industries mechanically be offering sure pay sessions over others, and those expectancies are shared through skilled trade workers. For instance, corporations within the scientific, development, hospitality, trucking, and customer support industries regularly pay weekly.

3. Consider state laws and regulations

Each state problems its personal regulations referring to how regularly you will have to pay workers, regularly the minimal pay length allowed. While you’ll be able to pay workers extra steadily than the state lets in, you can’t pay them much less steadily. For instance, listed below are some pay frequency regulations through state:

- Alaska: Requires pay both semi-monthly or month-to-month at a minimal.

- Arizona: Requires a minimum of two pay sessions monthly not more than 16 days aside.

- California: Companies will have to pay workers a minimum of two times a month at the days designated as common paydays with some exceptions.

- Kansas: Requires employers pay workers a minimum of month-to-month.

- Texas: Requires workers be paid semi-monthly, semi-weekly, or month-to-month. However, simplest workers who’re exempt from time beyond regulation consistent with the Fair Labor Standards Act (FLSA) will also be paid month-to-month; all different workers will have to be paid extra steadily.

4. Consider your payroll instrument’s scheduling boundaries

Now that you understand your corporate’s HR bandwidth, your workers’ personal tastes, and your state’s necessities, take into consideration the payroll instrument’s scheduling boundaries.

Number of month-to-month pay runs

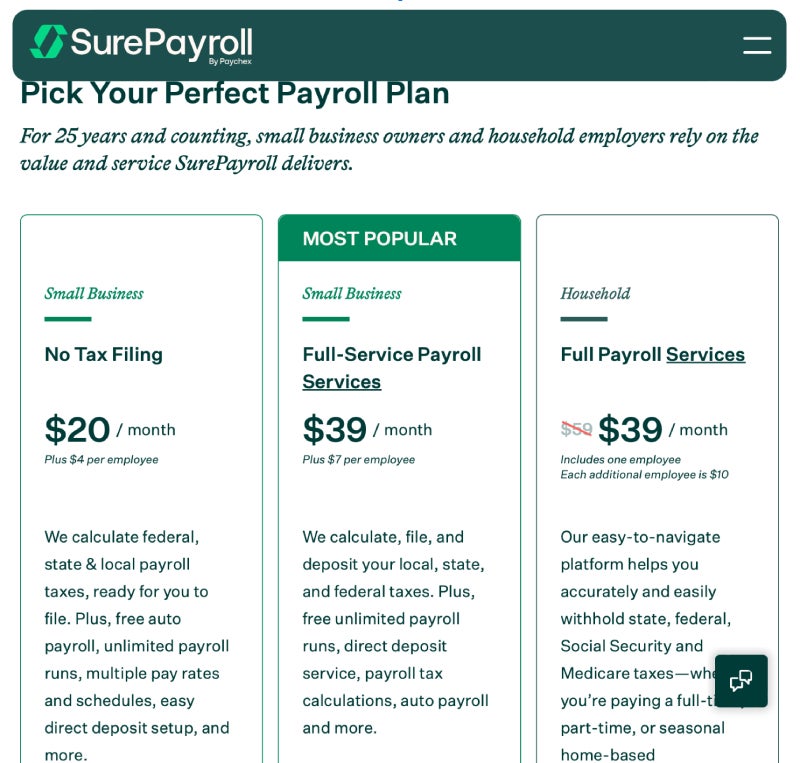

Some payroll suppliers permit for simplest month-to-month bills, whilst others be offering limitless payroll runs monthly. If your corporate makes use of payroll instrument that permits for limitless month-to-month payroll runs, you’ve extra choices, permitting you to even pay workers weekly. If your selected payroll instrument can’t accommodate your pay frequency wishes, chances are you’ll wish to improve your plan or imagine every other supplier.

Automations to scale

In addition, imagine what gear you’ve at your disposal to run payroll successfully; this lets you higher perceive what payroll frequency your group can deal with. For instance:

- While Patriot lets you pay workers as repeatedly as you need right through the month, it does now not be offering computerized payroll options in both of its payroll plans.

- Gusto prices virtually two times up to Patriot monthly however provides limitless payroll runs monthly and the method to run payroll on autopilot.

If you’re keen on Patriot and Gusto, take a look at their internet sites underneath.

4 steps to enforce a payroll agenda

To enforce a payroll agenda, practice those steps:

- Use the ideas and insights out of your payroll agenda variety procedure to both ascertain the gear you’ve will paintings smartly or make a selection new ones.

- Set up your payroll gear to house your scheduling wishes.

- Set your payroll agenda.

- Communicate your pay agenda insurance policies for your workers.

Here’s an in depth have a look at the way to entire each and every of those steps.

1. Choose your payroll instrument

Your first step to enforcing your payroll agenda is to make a choice a payroll instrument or carrier that may accommodate your pay frequency. Also imagine if your selected payroll instrument provides options that can help you automate payroll as wanted.

If your present payroll plan doesn’t accommodate your selected pay frequency, every other tier or an add-on might convert it into person who does. So, take a look at together with your supplier to resolve its additional features and boundaries.

2. Set up your payroll gear

Once you’ve decided on your plan, maximum payroll instrument be offering a guided setup. For instance, whilst you decide right into a Roll through ADP payroll plan, you will have to first obtain the Roll through ADP app from both the Apple App Store or the Google Play Store. Then, the app guides you via setup the use of a chat-based dialog. For instance, so as to add workers, you’ll be able to merely ship a “hire employee” message inside the app and the device will information you on the way to upload your worker.

If you might be migrating from one payroll supplier to every other, maximum suppliers be offering knowledge migration products and services. For instance, Rippling extracts all knowledge out of your previous supplier and imports it into your Rippling instrument account. Then, to make sure payroll accuracy, you’ll be able to run a comparability record between the closing paycheck you processed together with your prior payroll instrument and Rippling’s first payroll run.

3. Set up your payroll agenda

In this step, arrange your payroll agenda inside your selected payroll instrument. Most payroll instrument can help you fill out bureaucracy to set your payroll agenda. For instance, in OnPay, to arrange a bi-weekly or weekly pay agenda, you will have to first click on “add new” after clicking to increase the “subsequent scheduled payroll run“ tile inside your OnPay dashboard.

From there, you’re triggered to fill out a easy shape to call your pay agenda, your pay frequency, and the dates you need your first pay length to start out and finish. Then, click on “update” and overview your pay sessions at the supplied calendar for accuracy.

4. Communicate payroll agenda insurance policies to workers

It’s essential to incorporate payroll agenda insurance policies on your hiring paperwork. When you do, be aware any vacations that can adjust your pay agenda and be offering an evidence of ways you’re going to deal with those alterations.

Next, you’ll be able to supply workers with a payroll calendar for the yr; many payroll instrument suppliers be offering them free of charge. For instance, QuickBooks Payroll provides unfastened pay agenda templates for various pay frequencies. You can obtain and print them, or create them in Word or Google Sheets for virtual distribution.

In addition, many payroll instrument be offering workers a self-serve portal that delineates when their payday is and the volume they’ll obtain each and every pay length. Employees can get entry to this knowledge 24/7, even if your HR representatives don’t seem to be within the administrative center.

Payroll schedules: Frequently requested questions (FAQs)

What is the most typical payroll agenda?

Biweekly and semimonthly are the most typical pay schedules, with the previous being extra well-liked amongst hourly hard work forces and the latter being extra steadily used amongst salaried employees.

What is the most efficient payroll agenda for hourly workers?

Weekly and biweekly pay schedules are higher suited for hourly groups and crews, offering sooner bills, more straightforward accounting, and extra predictable bills general.

How does a payroll agenda paintings?

Regardless of the kind of repayment, the variables concerned, or the native laws, payroll for any given worker is outlined through a collection get started and finish level for the time-frame. Whatever calculations are serious about figuring out their pay quantity is then carried out inside that time frame, and the paycheck issued.

Payroll schedules are a predetermined structure for atmosphere the beginning and finish date of those pay sessions, so the industry, the group, and the related governing our bodies know what to anticipate.

How do I select a payroll agenda?

To select a payroll agenda, first imagine your small business wishes, together with your money drift agenda and your HR division’s time constraints. Then, additionally imagine state regulations round minimal pay sessions monthly, your workers’ wishes and personal tastes, and what features you’ve on your payroll gear to enact particular schedules, reminiscent of what number of pay runs are authorized monthly and if automation gear are to be had.

How do you exchange your payroll agenda in payroll instrument?

Most apps have a local procedure for atmosphere and converting a payroll agenda, even though steps inside each and every instrument’s person interface range through dealer, app, and instrument model. Keep in thoughts that making a metamorphosis regularly calls for that tax bureaus and governing our bodies be notified to keep away from opposed criminal penalties.

How do I create a payroll calendar?

The very best option to create a payroll calendar is to make use of payroll instrument that permits you to specify a payroll run cadence, reminiscent of weekly, bi-weekly, or month-to-month, then automate the calendar introduction procedure. Most of those gear additionally supply an worker self-service portal that provides workers get entry to to this calendar and gives reminders of upcoming pay days. Another manner of making a payroll calendar is through the use of a payroll calendar template that aligns together with your pay frequency, like those supplied through QuickBooks Payroll.

What are not unusual processing charges with payroll?

Labor from monetary pros, checking account and transaction prices, and instrument subscription charges are all items of this puzzle, particularly if companies need payroll to be virtual, let on my own computerized. In some instances, companies get monetary savings in the event that they run payroll 12 occasions a yr versus 24 occasions.

No Comment! Be the first one.