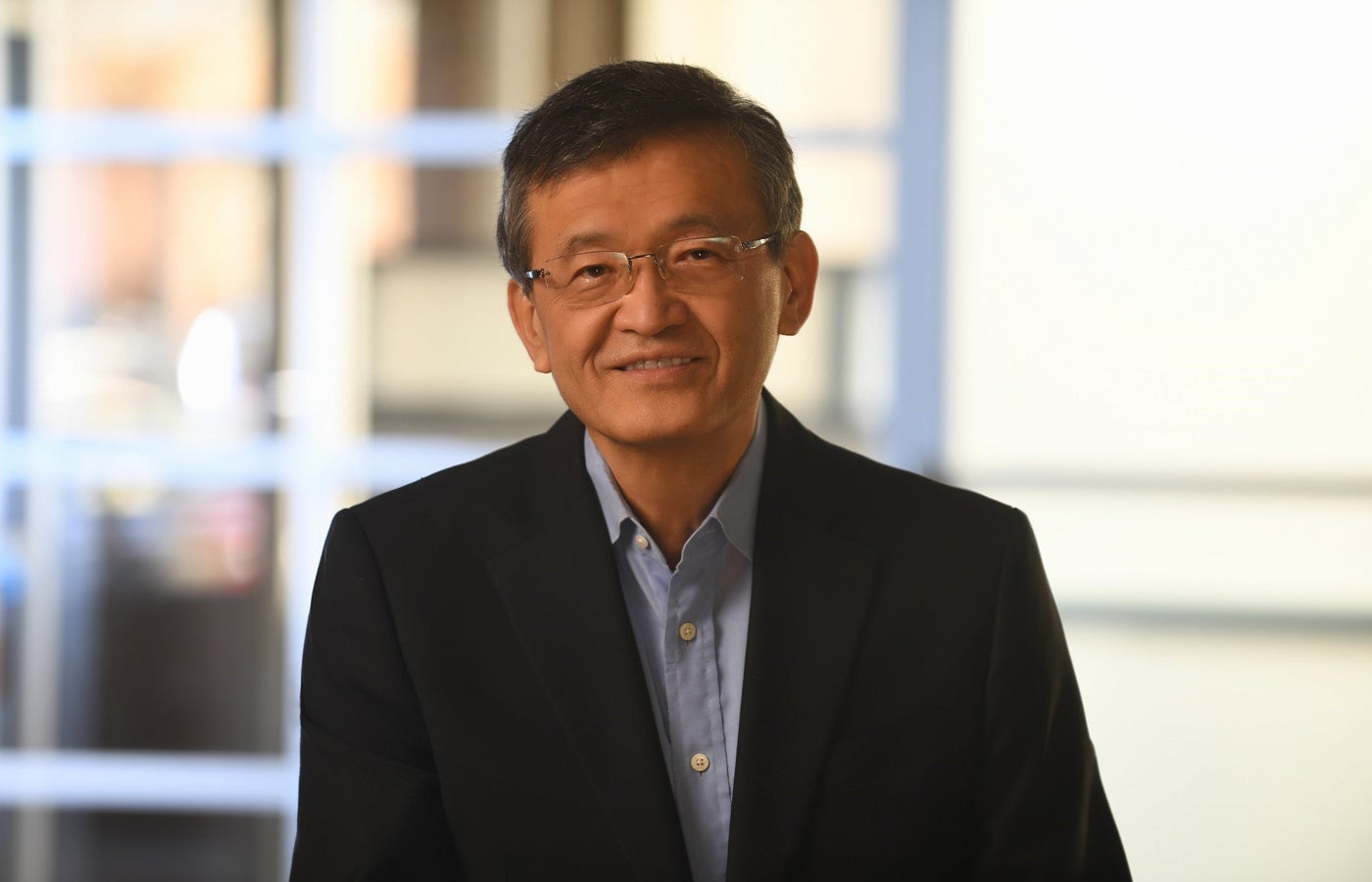

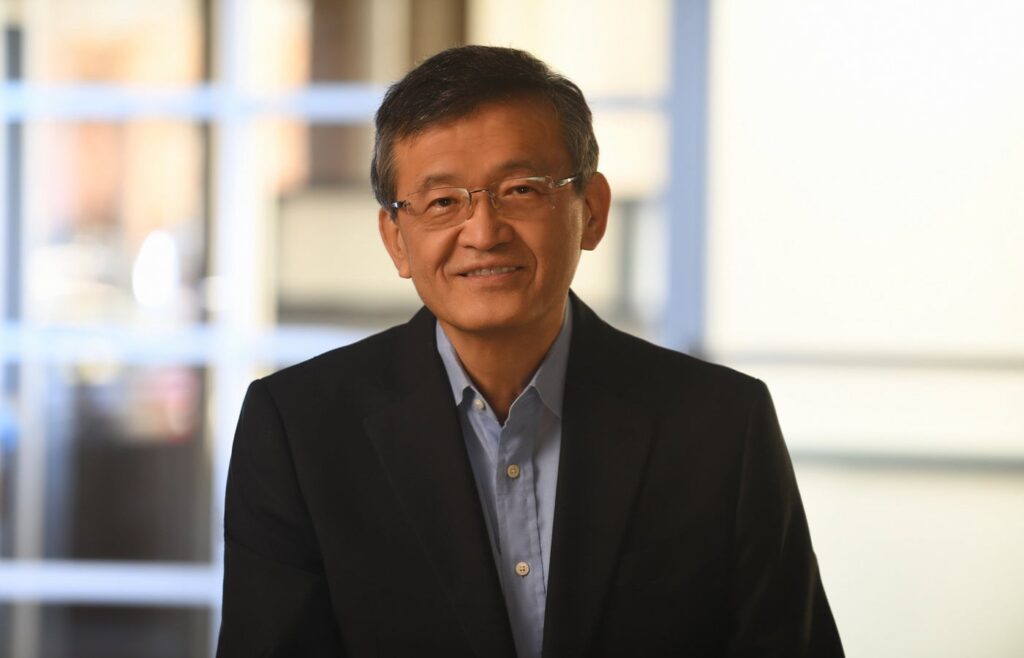

Intel has named chip business veteran Lip-Bu Tan as its new CEO, efficient March 18. The 65-year-old spent 12 years because the CEO of Cadence Design Methods, an organization specializing in software program and {hardware} options for chip design, throughout which he doubled its income. Tan additionally based a enterprise capital agency that has backed quite a few profitable tech startups and served on the boards of main tech firms, together with Intel, Hewlett Packard Enterprise, and Schneider Electrical.

“Collectively, we are going to work arduous to revive Intel’s place as a world-class merchandise firm, set up ourselves as a world-class foundry and delight our prospects like by no means earlier than,” Tan stated in a letter to Intel workers on Wednesday.

roosho breaks down key particulars in regards to the Malaysian-born government as he takes cost of the U.S. tech large.

1. Tan was on Intel’s board of administrators

As CEO of Cadence Design Methods, Tan oversaw the corporate’s provide of design options and IP to Intel. He additionally served on Intel’s board of administrators from 2022 to 2024. This was a major period for the corporate because it was shifting in direction of its IDM 2.0 technique, an effort aimed to modernize its manufacturing capabilities.

Tan resigned from the board in August, citing a “private resolution primarily based on a must reprioritize varied commitments.” His departure signaled his independence. Based on Reuters, he was pissed off with the corporate’s massive workforce and its bureaucratic, risk-averse tradition.

2. Tan is changing ousted CEO Gelsinger

He’s changing Pat Gelsinger, who was eliminated by Intel’s board in December 2024 following greater than 30 years on the firm. Gelsinger’s bold turnaround plan — which concerned funnelling cash into new fabs — failed to offer notable market share development or profitability.

Following Tan’s appointment, Intel’s shares surged by 12%, reflecting investor optimism. Not like an ex-financier who may push for fast positive factors via divestitures, Tan is predicted to take a extra strategic, long-term strategy relatively than adhering to legacy processes.

3. Tan will attempt to revive Intel’s chip enterprise

As soon as a dominant drive within the CPU business, Intel has struggled amid the AI growth and shifting business dynamics. Not like rivals who specialise in both chip design or manufacturing, Intel continues to function in each sectors — a technique that has left its fabrication efforts lagging behind TSMC.

In 2024, Intel’s inventory declined by 60%, and the corporate fell from first to second place on Gartner’s listing of high international semiconductor distributors by income development. With a background in each chip design and manufacturing, Tan is well-positioned to steer Intel’s turnaround.

SEE: Qualcomm, Intel, and Others Kind Ambient IoT Coalition

4. Tan must negotiate with U.S. chipmakers

Intel faces stress from rivals circling its customized chip foundries. In latest weeks, TSMC, NVIDIA, Broadcom, and AMD have been contemplating a joint takeover of Intel’s customized chip foundries, with NVIDIA and Broadcom initiating manufacturing testing.

TSMC and Broadcom have been additionally contemplating splitting Intel’s manufacturing and design arms, a transfer Intel execs are reportedly pushing again in opposition to. Tan’s management can be vital in figuring out how these negotiations unfold.

SEE: TSMC’s $100B Funding in US Knowledge Facilities Units Overseas Funding Report

5. Tan has Trump’s help

Based on Reuters, U.S. President Donald Trump inspired TSMC to assist revive Intel by taking on a few of its U.S. chipmaking factories. Trump, who has prioritized strengthening home chip manufacturing, opposes any plan that may end in full overseas possession of Intel’s property.

In consequence, TSMC is reportedly limiting its stake in Intel to beneath 50% to make sure regulatory approval beneath a possible Trump administration.

No Comment! Be the first one.